Tax Cuts and Jobs Act

[9][10] Extending the cuts have caused economists across the political spectrum to worry it would boost inflationary pressures[11][12] and worsen America's fiscal trajectory.

[33][34] The act exempts the discharge of certain student loans due to the death or total permanent disability of the borrower from taxable income.

[54] Endowment funds used to carry out a college's tax-exempt purpose are excluded from the asset threshold, but Internal Revenue Service has not issued regulations specifically defining this term.

[56] The Internal Revenue Service has clarified that the employer should use a reasonable method to determine the value of parking benefits provided to its employees.

Net operating losses generated before January 1, 2018, and carried forward to other tax years are not affected and can be used to offset gains from any trade or business activity.

[115] The Tax Policy Center (TPC) reported its macroeconomic analysis of the November 16 Senate version of the Act on December 1, 2017: The Penn Wharton Budget Model (PWBM) estimated relative to a prior law baseline that by 2027: CBO forecast in January 2017 (just prior to Trump's inauguration) that revenues in fiscal year 2018 would be $3.60 trillion if laws in place as of January 2017 continued.

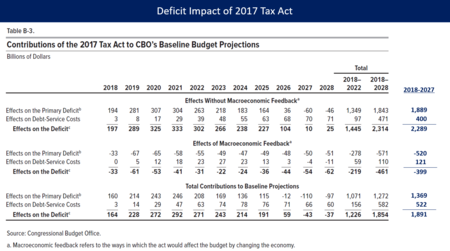

"[115] The Joint Committee on Taxation estimated the Act would add $1,456 billion total to the annual deficits (debt) over ten years.

This analysis excludes the impact of zeroing out the ACA individual mandate, which would apply significant costs primarily to income groups below $40,000.

[128] In October 2017, the Council of Economic Advisers estimated that the corporate tax cut contained within the TCJA would increase real median household income by $3,000 to $7,000 annually.

This pattern was evident even in early 2018, when Bloomberg reported (based on an analysis of 51 S&P 500 companies) that an estimated 60% of corporate tax savings was going to shareholders, while 15% was going to employees.

[132] A study by the Federal Reserve Bank similarly found that corporations bought-back stock and paid down debt, rather than undertake either new capital expenditure or investment in research & development.

[134] In the two years since the Act was passed, it failed to pay for itself through increased economic growth as initially claimed, according to Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

While only about one-in-five families between the 80th and 95th income percentiles in most red states would face higher taxes by 2027 under the House GOP bill, that number rises to about one-third in Colorado and Illinois, around two-fifths or more in Oregon, Virginia, Massachusetts, New York and Connecticut, and half or more in New Jersey, California and Maryland..."[143] Leading Republicans supported the bill, including President Donald Trump and Vice President Mike Pence, and Republicans in Congress, such as:[144] In the Senate, Republicans "eager for a major legislative achievement after the Affordable Care Act debacle ... have generally been enthusiastic about the tax overhaul.

[155] The 13 House Republicans who voted against the bill were mostly from New York, New Jersey, and California, and several were opposed to the $10,000 cap on the state and local income tax deduction.

[159] In a letter made public on the November 12, 2017, more than 400 millionaires and billionaires (which include George Soros and Steven Rockefeller) asked Congress to reject the Republican tax plan.

"[165] Editorial Boards of major US newspapers including USA Today,[166] The Washington Post,[167] the Los Angeles Times,[168] the San Francisco Chronicle[169] and The Boston Globe[170] also opposed the bill.

Paul Krugman disputed the Administration's primary argument that tax cuts for businesses will stimulate investment and higher wages:[171] In November 2017, the University of Chicago asked over 40 economists if U.S. GDP would be substantially higher a decade from now, if either the House or Senate bills were enacted, with the following results: 52% either disagreed or strongly disagreed, while 36% were uncertain and only 2% agreed.

[182] Former Clinton cabinet Treasury Secretary Larry Summers referred to the analysis provided by the Trump administration of its tax proposal as "...some combination of dishonest, incompetent, and absurd."

"[184] In the immediate aftermath of the passage of the Act, a relatively small number of corporations—many of them involved in mergers disputed by the government or regulatory difficulties—announced pay raises or bonuses to employees, although it is not clear they would not have done so without the tax cut (many companies award raises and bonuses early each year in the normal course of business, after their prior year earnings are known and their new budgets are put in place).

They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests."

However, a large inflow of foreign capital would drive up the price of the dollar, making U.S. exports more expensive, thus increasing the trade deficit.

The more the tax code distinguishes among types of earnings, personal characteristics or economic activities, the greater the incentive to label income artificially, restructure or switch categories in a hunt for lower rates.

[217][215] The revisions appeared "first in the lobbying shops of K Street, which sent back copies to some Senate Democrats, who were left to take to social media in protest regarding being asked to vote in a matter of hours on a massive bill that had yet to be shared with them directly.

[3][222] As a result, the name "Tax Cuts and Jobs Act", though widely used, is not contained in the bill, which is officially referred to by its long title, or as Public Law 115-97.

[225][226][227] In a survey conducted by the University of Chicago's Initiative on Global Markets, 37 out of 38 economists interviewed stated that they thought the Act would cause a rapid increase in the national debt.

[229] Four winners of the Nobel Prize in Economics have spoken out against the legislation: Joseph Stiglitz,[230] Paul Krugman,[171][231] Richard Thaler,[232] and Angus Deaton.

[238][239] In November 2017, Senator Lindsey Graham (R-SC) said that "financial contributions will stop" flowing to the Republican Party if tax reform is unable to be enacted.

[246] The final version of the Act reflected the Senate's language in this area, maintaining the prior law's tax exemption for tuition waivers.

[247] Under the Statutory Pay-as-You-Go Act of 2010 (PAYGO), laws that increase the federal deficit will trigger automatic spending cuts unless Congress votes to waive them.

In December 2018, Judge Reed O'Connor of the District Court of Northern Texas issued his opinion in agreement with the states that without the individual mandate, the whole of the ACA had no standing.