Tax noncompliance

[2] Its most general use describes non-compliant behaviors with respect to different institutional rules resulting in what Edgar L. Feige calls unobserved economies.

[3] Non-compliance with fiscal rules of taxation gives rise to unreported income and a tax gap that Feige estimates to be in the neighborhood of $500 billion annually for the United States.

[5] Laws known as a General Anti-Avoidance Rule (GAAR) statutes which prohibit "tax aggressive" avoidance have been passed in several developed countries including the United States (since 2010),[6] Canada, Australia, New Zealand, South Africa, Norway and Hong Kong.

The decline or deterioration of taxation practices will reduce the moral costs of taxpayers engaging in illegal operations or underground economic activities.

Bird believed that a sustainable and efficient tax system must be based on perceived fairness and goodwill response to taxation.

[16] The economic experiments cited by Torgler and Schaltegger[17] show that the extensive exercise of voting rights in tax affairs will significantly increase taxpayer compliance.

Everest Phillips[18] believes that the design of a reasonable and effective tax system is an important part of the construction in a country.

The operation of this tax system must be based on the higher compliance of taxpayers and the goodness of taxation rather than relying on coercive measures.

They believe that wages and other income of workers in the informal sector in developing countries are still free from tax collection.

The statute is Internal Revenue Code section 7201: Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall, in addition to other penalties provided by law, be guilty of a felony and, upon conviction thereof, shall be fined not more than $100,000 ($500,000 in the case of a corporation), or imprisoned not more than 5 years, or both, together with the costs of prosecution.

That is, an act which would otherwise be perfectly legal (such as moving funds from one bank account to another) could be grounds for a tax evasion conviction (possibly an attempt to evade payment), provided the other two elements are also met.

[26] Under the Cheek Doctrine (Cheek v. United States),[27] the United States Supreme Court ruled that a genuine, good faith belief that one is not violating the federal tax law (such as a mistake based on a misunderstanding caused by the complexity of the tax law itself) would be a valid defense to a charge of "willfulness" ("willfulness" in this case being knowledge or awareness that one is violating the tax law itself), even though that belief is irrational or unreasonable.

With respect to willfulness, the placing of the burden of proof on the prosecution is of limited utility to a defendant that the jury simply does not believe.

In the Cheek case the Court stated: Claims that some of the provisions of the tax code are unconstitutional are submissions of a different order.

Thus, in this case, Cheek paid his taxes for years, but after attending various seminars and based on his own study, he concluded that the income tax laws could not constitutionally require him to pay a tax.The Court continued: We do not believe that Congress contemplated that such a taxpayer, without risking criminal prosecution, could ignore the duties imposed upon him by the Internal Revenue Code and refuse to utilize the mechanisms provided by Congress to present his claims of invalidity to the courts and to abide by their decisions.

As we see it, he is in no position to claim that his good-faith belief about the validity of the Internal Revenue Code negates willfulness or provides a defense to criminal prosecution under 7201 and 7203.

By pointing out that arguments about constitutionality of federal income tax laws "reveal full knowledge of the provisions at issue and a studied conclusion, however wrong, that those provisions are invalid and unenforceable", the Supreme Court may have been impliedly warning that asserting such "constitutional" arguments (in open court or otherwise) might actually help the prosecutor prove willfulness.

[30] Daniel B. Evans, a tax lawyer who has written about tax protester arguments, has stated that if you plan ahead to use it [the Cheek defense], then it is almost certain to fail, because your efforts to establish your "good faith belief" are going to be used by the government as evidence that you knew that what you were doing was wrong when you did it, which is why you worked to set up a defense in advance.

In R. v. Klundert, 2011 ONCA 646, the Ontario Court of Appeal upheld a tax protestor's conviction, but allowed him to serve a conditional sentence in the community on the grounds that his behaviour was neither fraudulent nor deceitful.

To the extent the trial judge did consider the appellant's low level of deceit, if any, and lack of fraud, it was not fairly emphasized in his reasons and amounts to error.According to some estimates, about three percent of American taxpayers do not file tax returns at all.

[33] In cases where a taxpayer does not have enough money to pay the entire tax bill, the IRS can work out a payment plan with taxpayers, or enter into a collection alternative such as a partial payment Installment Agreement, an Offer in Compromise, placement into hardship or "currently non-collectable" status or file bankruptcy.

For years for which no return has been filed, there is no statute of limitations on civil actions – that is, on how long the IRS can seek taxpayers and demand payment of taxes owed.

[36] The IRS has run several Overseas Voluntary Disclosure Programs in 2009 and 2011, and its current one has "no set deadline for taxpayers to apply.

The United Kingdom and jurisdictions following the UK approach (such as New Zealand) have recently adopted the evasion/avoidance terminology as used in the United States: evasion is a criminal attempt to avoid paying tax owed while avoidance is an attempt to use the law to reduce taxes owed.

Tax avoidance is a course of action designed to conflict with or defeat the evident intention of Parliament: IRC v Willoughby.

Thus UK courts refused to regard sales and repurchases (known as bed-and-breakfast transactions) or back-to-back loans as tax avoidance.

However, a transaction is not well described as "artificial" if it has valid legal consequences, unless some standard can be set up to establish what is "natural" for the same purpose.

An example is the notorious UK case Ayrshire Employers Mutual Insurance Association v IRC,[42] where the House of Lords held that Parliament had "missed fire".

[48] In the UK case of Cheney v. Conn,[49] an individual objected to paying tax that, in part, would be used to procure nuclear arms in unlawful contravention, he contended, of the Geneva Convention.

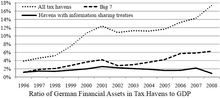

[51] Richard Murphy, a professor in Public Policy at City, University of London, produced the following estimates of the tax gap in different European countries.