Taxation in New Zealand

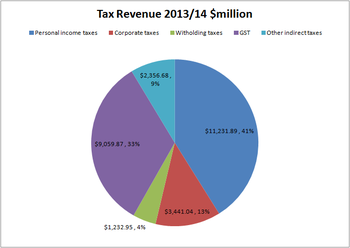

National taxes are levied on personal and business income, and on the supply of goods and services.

Capital gains tax applies in limited situations, such as the sale of some rental properties within 10 years of purchase.

Issues include: New Zealand has jurisdiction to tax individuals on the basis of residence and source.

[5] The tax did not apply to individuals with income less than £300 per annum, which exempted most of the population, and the top rate was 5%.

[9] The Fourth Labour Government, with David Lange as prime minister and Roger Douglas as finance minister, introduced a goods and services tax in 1986 and then reduced the top income tax rate from 66% to 48% in 1988 and then 33% in 1989.

The test does not apply to profit from the family home, death estate, or property sold as part of a relationship settlement.

At the initial implementation in 2015, profit on houses bought and sold within two years were subject to income tax.

[18] Generally profits made from frequent stock trading will be deemed taxable income.

The earners' levy rate (including GST) for the period 1 April 2022 to 31 March 2023 is 1.46% ($1.46 per $100).

[22] In most cases employers deduct the relevant amount of income tax from salary and wages prior to these being paid to the individual.

This system, known as pay-as-you-earn, or PAYE, was introduced in 1958, prior to which employees paid tax annually.

The agreement with the United States, for example, prohibits New Zealand from taxing American social security or government pension payments, and the reverse is also true.

[26] All employees pay an earner's levy to cover the cost of non-work related injuries.

It is collected by Inland Revenue on behalf of the Accident Compensation Corporation (ACC).

This represented a major change in New Zealand taxation policy as until this point almost all revenue had been raised via direct taxes.

[39] There are several methods available for calculating FBT liability, including an option of paying a flat rate of 49.25% on all benefits provided.

A graded, dual-rate, or split-rate property tax applies a different rate to improvement values.

The term "land tax valuation" is used to represent both its pure and partial forms.

In contrast, an LVT applies to the land itself – taking into account its scarcity, immovability and centrality to human activity.

to be duplicative due to their similarity to local-authority property-rate levies, with property taxes (rates) making up 57% of local-government income by 2001.