Trade-off theory of capital structure

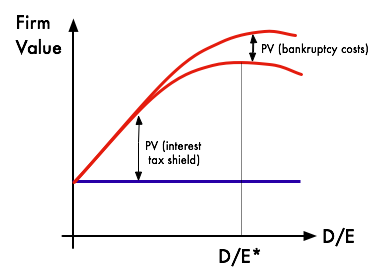

The classical version of the hypothesis goes back to Kraus and Litzenberger[1] who considered a balance between the dead-weight costs of bankruptcy and the tax saving benefits of debt.

[2] A review of the trade-off theory and its supporting evidence is provided by Ai, Frank, and Sanati.

[4] Taxes are large and they are sure, while bankruptcy is rare and, according to Miller, it has low dead-weight costs.

Accordingly, he suggested that if the trade-off theory were true, then firms ought to have much higher debt levels than we observe in reality.

Myers was a particularly fierce critic in his Presidential address to the American Finance Association meetings in which he proposed what he called "the pecking order theory".