United States Treasury security

The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets.

Although the United States is a sovereign power and may default without recourse, its strong record of repayment has given Treasury securities a reputation as one of the world's lowest-risk investments.

This low risk gives Treasuries a unique place in the financial system, where they are used as cash equivalents by institutions, corporations, and wealthy investors.

[3] After the war, the Liberty bonds were reaching maturity, but the Treasury was unable to pay each down fully with only limited budget surpluses.

The system suffered from chronic over-subscription, where interest rates were so attractive that there were more purchasers of debt than required by the government.

[4] The types and procedures for marketable security issues are described in the Treasury's Uniform Offering Circular (31 CFR 356).

[5] Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different number of months.

These are sold through a discount auction process like regular bills, but are irregular in the amount offered, the timing, and the maturity term.

[6] Before the introduction of the four-week bill in 2001, the Treasury sold CMBs routinely to ensure short-term cash availability.

[8] Treasury bills are quoted for purchase and sale in the secondary market on an annualized discount percentage, or basis.

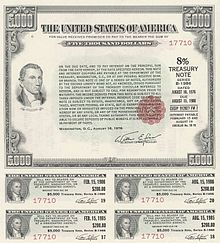

As with a conventional fixed-rate instrument, holders are paid the par value of the note when it matures at the end of the two-year term.

However, because of demand from pension funds and large, long-term institutional investors, along with a need to diversify the Treasury's liabilities—and also because the flatter yield curve meant that the opportunity cost of selling long-dated debt had dropped—the 30-year Treasury bond was re-introduced in February 2006 and is now issued quarterly.

[18] The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the consumer price index (CPI), the most commonly used measure of inflation.

[19] The adjustments to the principal increase interest income when the CPI rises, thus protecting the holder's purchasing power.

[20] Finance scholars Martinelli, Priaulet and Priaulet state that inflation-indexed securities in general (including those used in the United Kingdom and France) provide efficient instruments to diversify portfolios and manage risk because they have a weak correlation with stocks, fixed-coupon bonds and cash equivalents.

[21] A 2014 study found that conventional U.S. Treasury bonds were persistently mispriced relative to TIPS, creating arbitrage opportunities and posing "a major puzzle to classical asset pricing theory.

Unlike Treasury Bonds, they are not marketable, being redeemable only by the original purchaser (or beneficiary in case of death).

In 2002, the Treasury Department started changing the savings bond program by lowering interest rates and closing its marketing offices.

Series EE bonds pay a fixed rate but are guaranteed to pay at least double the purchase price when they reach initial maturity at 20 years; if the compounded interest has not resulted in a doubling of the initial purchase amount, the Treasury makes a one-time adjustment at 20 years to make up the difference.

The Treasury issues SLGS securities at its discretion and has suspended sales on several occasions to adhere to the federal debt ceiling.

[citation needed] In June 2024 approximately $27 trillion of outstanding Treasury securities, representing 78% of the public debt, belonged to domestic holders.