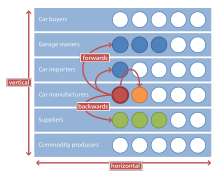

Vertical integration

Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation (as in the 1920s when the Ford River Rouge complex began making much of its own steel rather than buying it from suppliers).

On the undesirable side, when vertical expansion leads toward monopolistic control of a product or service then regulative action may be required to rectify anti-competitive behavior.

Disintermediation is a form of vertical integration when purchasing departments take over the former role of wholesalers to source products.

Problems that can stem from vertical integration can include large capital investments needed to set up and buy factories and maintain efficient profits.

[10] Vertically integrated firms rarely need to worry about the sufficiency in their supply of materials because they generally control the facilities that provide them.

[13] A vertically integrated company also creates high barriers of entry into their respective economy, eliminating most potential competition.

[13] Implementing vertical integration can be beneficial in that it reduces the distance that separates the suppliers and customers from the resources or information, which can then boost profits and efficiency.

Members of the supply chain, such as farmers and small food retailers, could not afford the high cost of equipment, so Birdseye provided it to them.

This produced a slower information processing rate, with the side effect of making the company so slow that it could not react quickly.

Alibaba has built its leadership in the market by gradually acquiring complementary companies in a variety of industries including delivery and payments.

[17][full citation needed] Later, Carnegie established an institute of higher learning to teach the steel processes to the next generation.

Oil companies, both multinational (such as ExxonMobil, Shell, ConocoPhillips or BP) and national (e.g., Petronas) often adopt a vertically integrated structure, meaning that they are active along the entire supply chain from locating deposits, drilling and extracting crude oil, transporting it around the world, refining it into petroleum products such as petrol/gasoline, to distributing the fuel to company-owned retail stations, for sale to consumers.

[citation needed] Standard Oil is a famous example of both horizontal and vertical integration, combining extraction, transport, refinement, wholesale distribution, and retail sales at company-owned gas stations.

In order to implement a telecommunications system that connected cities across a nation reliably, vertical integration was called upon.

Vertical integration requires a company to focus not only on its core business, but also on several difficult areas such as sourcing materials and manufacturing partners, distribution, and finally selling the product.

[20] Apple is also known as one of the world's leading "orchestrators" as they exert control over the entire value chain, but do not do everything in-house (e.g. assembly of iPhones by manufacturing partner Foxconn).

[21] From the early 1920s through the early 1950s, the American motion picture had evolved into an industry controlled by a few companies, a condition known as a "mature oligopoly", as it was led by eight major film studios, the most powerful of which were the "Big Five" studios: MGM, Warner Brothers, 20th Century Fox, Paramount Pictures, and RKO.

[citation needed] The issue of vertical integration (also known as common ownership) has been the main focus of policy makers because of the possibility of anti-competitive behaviors affiliated with market influence.

[23] The prevalence of vertical integration wholly predetermined the relationships between both studios and networks[clarification needed] and modified criteria in financing.

Lacking the financial resources and contract talent they once controlled, the studios now relied on independent producers supplying some portion of the budget in exchange for distribution rights.

Farm contracts contain detailed conditions for growers, who are paid based on how efficiently they use feed, provided by the integrator, to raise the animals.

The contract dictates how to construct the facilities, how to feed, house, and medicate the animals, and how to handle manure and dispose of carcasses.

[26] Jim Hightower, in his book, Eat Your Heart Out,[28] discusses this liability role enacted by large food companies.

This allowed for manageable division of labor, decreased costs in delay and exchange of goods, and organized updates of each firm in the supply chain.

[31] EssilorLuxottica, the company that merged with Essilor and Luxottica, occupies up to 30% of the global market share as well as representing billions of pairs of lenses and frames sold annually.

The vertical merge allowed CVS-Aetna to regulate more of the healthcare and delivery chain and gave them the ability to provide higher quality care to consumers.

Partial deregulation in the US in 1978 (PURPA) forced the utilities to buy electricity outside if the rates were competitive; this gave rise to independent power producers.

Economists develop principles in which an economy adheres to, which provides insight onto the relationships between economic events, markets, companies, and the government.

[39] In economic theory, vertical integration has been studied in the literature on incomplete contracts that was developed by Oliver Hart and his coauthors.

For instance, DeMeza and Lockwood (1998) have studied different bargaining games,[42] while Schmitz (2006) has introduced asymmetric information into the incomplete contracting setup.