War bond

Traditionally they dealt with a small group of rich financiers such as Jakob Fugger and Nathan Rothschild, but no particular distinction was made between debt incurred in war or peace.

[citation needed] The government awarded communities who bought large amounts of bonds Victory Loan Honour Flags.

[9] Unlike France and Britain, at the outbreak of the First World War Germany found itself largely excluded from international financial markets.

[10] As such, Germany was largely limited to domestic borrowing, which was induced by a series of war credit bills passing the Reichstag.

[13] Industries, university endowments, local banks and even city governments were the prime investors in the war bonds.

Under this Act the Treasury issued £300 million (equivalent to £25.1 billion in 2013) of paper banknotes, without the backing of gold, with which the banks could repay their obligations.

[15] Leading banker Walter Leaf described these Treasury notes as "essentially a War Loan free of interest, for an unlimited period, and as such was a highly profitable expedient from the point of view of the Government".

[17] It was revealed in 2017 that public subscriptions amounted to £91m, and the balance had been subscribed by the Bank of England, under the names of then governor, John Gordon Nairne, and his deputy Ernest Harvey.

[15] In his memoirs Lloyd George stated his regret that his successor Reginald McKenna increased the interest rate at a time when investors had few alternatives.

[17] Compared to France, the British government relied more on short-term financing in the form of treasury bills and exchequer bonds during World War I.

The third War Loan was launched in January 1917 at a 5% discount to face value and paying 5% interest (or 4% tax-free for 25 years), a rate Lloyd George described as "penal".

[15] Labour politician Tom Johnston would later write of the 1917 War Loan "No foreign conqueror could have devised a more complete robbery and enslavement of the British Nation".

[22] Although they were obliged to give 90 days' notice of such a change, a 1% tax-free cash bonus was offered to holders who acted by 31 July.

[23] In 1917 and 1918, the United States government issued Liberty Bonds to raise money for its involvement in World War 1.

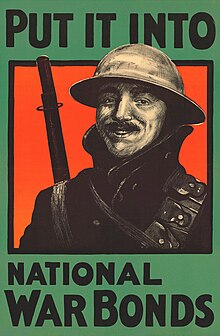

An aggressive campaign was created by Secretary of the Treasury William Gibbs McAdoo to popularize the bonds, grounded largely as patriotic appeals.

Al Jolson, Ethel Barrymore, Marie Dressler, Elsie Janis, Theda Bara, Fatty Arbuckle, Mabel Normand, Mary Pickford, Douglas Fairbanks and Charlie Chaplin were among the celebrities who made public appearances promoting the patriotic element of purchasing Liberty Bonds.

[30] War Savings Certificates began selling in May 1940 and were sold door-to-door by volunteers as well as at banks, post offices, trust companies and other authorised dealers.

[32] The government spent over $3 million on marketing which employed posters, direct mailing, movie trailers (including some by Walt Disney in cooperation with the newly established National Film Board of Canada's animation department that the former partner helped establish),[33] radio commercials and full page advertisements in most major daily newspapers and weekly magazines.

[34] Realistic staged military invasions, such as the If Day scenario in Winnipeg, Manitoba, were even employed to raise awareness and shock citizens into purchasing bonds.

[36] The Reich government did not want to present any perceived form of public referendum on the war, which would be the indirect result if a bond drive did poorly.

Through this strategy, 40 million bank and investment accounts were quietly converted into war bonds, providing the Reich government with a continuous supply of money.

By the summer of 1940, the victories of Nazi Germany against Poland, Denmark, Norway, Belgium, the Netherlands, France, and Luxembourg brought urgency to the government, which was discreetly preparing for possible United States involvement in World War II.

Many of President Franklin D. Roosevelt's advisers favored a system of tax increases and enforced savings program as advocated by British economist John Maynard Keynes.

[39] However, Secretary of the Treasury Henry Morgenthau Jr. preferred a voluntary loan system and began planning a national defense bond program in the fall of 1940.

[40] Henry Morgenthau Jr. sought the aid of Peter Odegard, a political scientist specialised in propaganda, in drawing up the goals for the bond program.

[41] Like the baby bonds, they were sold for as little as $18.75 and matured in ten years, at which time the United States government paid the bondholder $25.

Norman Rockwell's painting series, the Four Freedoms, toured in a war bond effort that raised $132 million.

Named after the 1942 Hollywood Victory Caravan, a 1945 Paramount-produced film promoted bond sales after the end of World War II.

The short subject included Bing Crosby, Bob Hope, Alan Ladd, William Demarest, Franklin Pangborn, Barbara Stanwyck, Humphrey Bogart, and others.

On 1 March 2022, following the 2022 Russian invasion of Ukraine, the Ukrainian government announced it would issue war bonds to pay its armed forces.