Welfare state

[8] However, during the Second World War, Anglican Archbishop William Temple, author of the book Christianity and the Social Order (1942), popularized the concept using the phrase "welfare state".

[10] At the time he wrote Sybil, Disraeli (later a prime minister) belonged to Young England, a conservative group of youthful Tories who disagreed with how the Whigs dealt with the conditions of the industrial poor.

He consciously tried to adopt it as a matter of state policy; he declared that "all men are my children"[12] and "whatever exertion I make, I strive only to discharge debt that I owe to all living creatures."

The interpretation of Ashoka's dharma after conversion is controversial, but in particular, the texts which describe him personally ordering the massacre of Buddhist heretics and Jains have been disputed by many scholars, since these are directly contradictory to his own edicts, and are legendary in nature.

[33] The concept of states taxing for the welfare budget was introduced to the Arabs in the early 7th century by caliph Omar, most likely adapted from the newly Roman territories.

[34] Zakat is also one of the five pillars of Islam and is a mandatory form of 2.5% Wealth tax to be paid by all individuals holding above a basic threshold (nisab) to provide for the needy once a year after Ramadan.

[39] Changed attitudes in reaction to the worldwide Great Depression of the 1930s, which brought unemployment and misery to millions, were instrumental in the move to the welfare state in many countries.

[41] In the period following World War II, some countries in Western Europe moved from partial or selective provision of social services to relatively comprehensive "cradle-to-grave" coverage of the population.

[44][45] Historian of the 20th-century fascist movement, Robert Paxton, observes that the provisions of the welfare state were enacted in the 19th century by religious conservatives to counteract appeals from trade unions and socialism.

[46] Later, Paxton writes "All the modern twentieth-century European dictatorships of the right, both fascist and authoritarian, were welfare states… They all provided medical care, pensions, affordable housing, and mass transport as a matter of course, in order to maintain productivity, national unity, and social peace.

The example countries are categorized as follows: Catholic – Spain, Italy and France; Lutheran – Denmark, Sweden and Germany; Reformed Protestant – Netherlands, the UK and the USA.

Under universal models such as Sweden, on the other hand, the state distributes welfare to all people who fulfill easily established criteria (e.g. having children, receiving medical treatment, etc.)

[50] Sociologist Lane Kenworthy argues that the Nordic experience demonstrates that the modern social democratic model can "promote economic security, expand opportunity, and ensure rising living standards for all ... while facilitating freedom, flexibility and market dynamism.

[58] According to Keerty Nakray, Esping-Andersen's three types of dimensions (state and market relations, stratification, and social citizenship rights) does not acknowledge unpaid care-work done by women within the household economy.

The focus of the UBI is granting individuals more freedom in determining life choices by providing a lifetime of financial security regardless of one's career preferences or lifepath.

[60] According to statements of American Enterprise Institute-affiliated Libertarian/conservative scholar Charles Murray, recalled and sanctioned by the George Gibbs Chair in Political Economy and Senior Research Fellow at the Mercatus Center at George Mason University and nationally syndicated columnist[61][62] Veronique de Rugy, as of 2014, the annual cost of a UBI in the US would have been about $200 billion cheaper than the US system put in place at that date.

In the Third Republic, especially between 1895 and 1914 "Solidarité" ["solidarism"] was the guiding concept of a liberal social policy, whose chief champions were the prime ministers Leon Bourgeois (1895–96) and Pierre Waldeck-Rousseau (1899–1902).

[77][78][79] Bismarck further won the support of both industry and skilled workers through his high-tariff policies, which protected profits and wages from American competition, although they alienated the liberal intellectuals who wanted free trade.

It is a medical card that provides extended subsidies exclusively for Singaporean citizens usually from lower-to-middle income households, as well as the older generations, where they could receive treatment for common illnesses, chronic health problems and specific dental issues at private clinics for free.

The intentions behind the scheme were to encourage Singaporeans to use such a card and tap into the private healthcare sector for common or minor chronic illnesses, as well as dental care, to reduce the strain at public community hospitals.

[114] About the British welfare state, historian Derek Fraser wrote: It germinated in the social thought of late Victorian liberalism, reached its infancy in the collectivism of the pre-and post-Great War statism, matured in the universalism of the 1940s and flowered in full bloom in the consensus and affluence of the 1950s and 1960s.

American spending on health care (as a percent of GDP) is the highest in the world, but it is a complex mix of federal, state, philanthropic, employer and individual funding.

The disproportionate number of racial and sexual minorities in private sector jobs with weaker benefits, he argues, is evidence that the American welfare state is not necessarily intended to improve the economic situation of such groups.

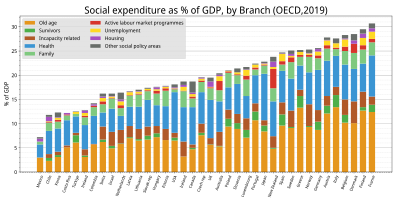

Martin Eiermann wrote: According to the OECD, social expenditures in its 34 member countries rose steadily between 1980 and 2007, but the increase in costs was almost completely offset by GDP growth.

[147] In the 20th century, opponents of the welfare state have expressed apprehension about the creation of a large, possibly self-interested, bureaucracy required to administer it and the tax burden on the wealthier citizens that this entailed.

[148] Conservative and libertarian groups such as The Heritage Foundation[149] and the Cato Institute[150] argue that welfare creates dependence, a disincentive to work and reduces the opportunity of individuals to manage their own lives.

Ryan further wrote: The modern welfare state, does not set out to make the poor richer and the rich poorer, which is a central element in socialism, but to help people to provide for themselves in sickness while they enjoy good health, to put money aside to cover unemployment while they are in work, and to have adults provide for the education of their own and other people's children, expecting those children's future taxes to pay in due course for the pensions of their parents' generation.

And people have only begun to study systematically to what extent the threat, real or imagined, of this type of radical regime really influenced policy changes in Western democracies.

That's a contributing factor, arguably, that the end of the Cold War coincides roughly with the time when inequality really starts going up again, because elites are much more relaxed about the possibility of credible alternatives or threats being out there.

In 1980, Ronald Reagan's presidential campaign relied on anti-poor tactics and the anti-black strategy of putting down the black vote in order to win the favor of the white populace.