Wells Fargo

A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services.

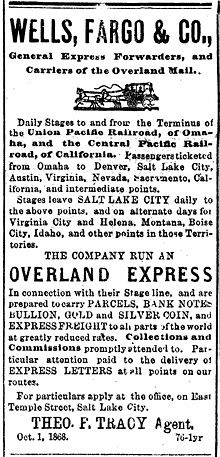

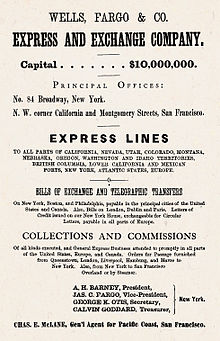

[27] In 1872, Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad, became president of the company after acquiring a large stake, a position he held until 1892.

[35] The robbery was organized by Los Macheteros (a guerrilla group seeking Puerto Rican independence from the United States) and involved an insider armored truck guard.

[60] The next day, a New York state judge issued a temporary injunction blocking the transaction from going forward while the competing offer from Citigroup was sorted out.

[63] On October 28, 2008, Wells Fargo received $25 billion of funds via the Emergency Economic Stabilization Act in the form of a preferred stock purchase by the United States Department of the Treasury.

[102] In September 2021, Wells Fargo incurred further fines from the United States Justice Department charging fraudulent behavior by the bank against foreign-exchange currency trading customers.

[105] Subsequently, in 2023, prison sentencing took place for employee-directed money laundering and funneling cash illegally to Mexico through the creation of fictitious accounts.

[106] In 1981, it was discovered that a Wells Fargo assistant operations officer, Lloyd Benjamin "Ben" Lewis, had perpetrated one of the largest embezzlements in history through its Beverly Drive branch.

[108]) Illinois Attorney General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the bank steered African Americans and Hispanics into high-cost subprime loans.

The report presented data from the city of Baltimore, where more than half the properties subject to foreclosure on a Wells Fargo loan from 2005 to 2008 now stand vacant, and 71 percent of those are in predominantly black neighborhoods.

[111][112][113] In a March 2010 agreement with US federal prosecutors, Wells Fargo acknowledged that between 2004 and 2007 Wachovia had failed to monitor and report suspected money laundering by narcotics traffickers, including the cash used to buy four planes that shipped a total of 22 tons of cocaine into Mexico.

[115][116] In May 2013, Wells Fargo paid $203 million to settle class-action litigation accusing the bank of imposing excessive overdraft fees on checking-account customers.

[117] On February 9, 2012, it was announced that the five largest mortgage servicers (Ally Financial, Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo) agreed to a settlement with the US Federal Government and 49 states over improper foreclosure practices in the 2010 United States foreclosure crisis, including "robo-signing" (having someone fraudulently sign that they know the contents of a document they do not in fact know) and foreclosing without standing via MERS.

[127] In 2016, Wells Fargo agreed to pay $1.2 billion to settle allegations that the company violated the False Claims Act by underwriting over 100,000 Federal Housing Administration (FHA) backed loans when over half of the applicants did not qualify for the program.

[132] In December 2011, Public Campaign criticized Wells Fargo for spending $11 million on lobbying during 2008–2010, while increasing executive pay and laying off workers, while having no federal tax liability due to losses from the Great Recession.

[137][138] In August 2020, the company agreed to pay $7.8 million in back wages for allegedly discriminating against 34,193 African Americans in hiring for tellers, personal bankers, customer sales and service representatives, and administrative support positions.

The board chose to use a clawback clause in the retirement contracts of Stumpf and Tolstedt to recover $75 million worth of cash and stock from the former executives.

[152] In February 2020, the company agreed to pay $3 billion to settle claims by the United States Department of Justice and the Securities and Exchange Commission.

[154] In December 2022, the bank agreed to a settlement with the CFPB of $3.7 billion over abuses tied to the fake account scandal as well as mortgages and auto loans.

[156] In November 2016, Wells Fargo agreed to pay $50 million to settle allegations of overcharging hundreds of thousands of homeowners for appraisals ordered after they defaulted on their mortgage loans.

[159] In December 2016, the Financial Industry Regulatory Authority fined Wells Fargo $5.5 million for failing to store electronic documents in a "write once, read many" format, which makes it impossible to alter or destroy records after they are written.

[162] Scharf claimed Wells Fargo's relationship with the NRA was "declining," with the company no longer participating in the organization's line of credit and mortgage loan commitments.

[163] In June 2018, about a dozen female Wells Fargo executives from the wealth management division met in Scottsdale, Arizona to discuss the minimal presence of women occupying senior roles within the company.

[165] There were also complaints against company president Jay Welker, who is also the head of the Wells Fargo wealth management division, due to his sexist statements regarding female employees.

[172] With CEO John Stumpf being paid 473 times more than the median employee, Wells Fargo ranked number 33 among the S&P 500 companies for CEO—employee pay inequality.

A Wells Fargo & Company stagecoach is seen passing through the town of Hill Valley as Marty is walking down the street in the 1990 film, Back to the Future Part III.

On March 2, 2022, Wells Fargo announced $1 million donation to the American Red Cross that will be used for Ukrainian refugees fleeing from the Russian invasion.

[179] In April 2023, TD Jakes Group and Wells Fargo have formalized a 10-year partnership to create inclusive communities for people of all income levels.

Previously, she had held leadership roles at FICO, a leading data and analytics company, and at Wells Fargo, she was responsible for helping low-income populations as head of philanthropy for financial health.

[181] On Sep 23, 2024,Wells Fargo launched a $1.6 billion delayed-draw term loan to support Tempur Sealy International's acquisition of Mattress Firm Group.