Zero-sum game

[4] In contrast, non-zero-sum describes a situation in which the interacting parties' aggregate gains and losses can be less than or more than zero.

Zero-sum games are most often solved with the minimax theorem which is closely related to linear programming duality,[5] or with Nash equilibrium.

The idea of Pareto optimal payoff in a zero-sum game gives rise to a generalized relative selfish rationality standard, the punishing-the-opponent standard, where both players always seek to minimize the opponent's payoff at a favourable cost to themselves rather than prefer more over less.

[11] The player in the game has a simple enough desire to maximise the profit for them, and the opponent wishes to minimise it.

Émile Borel and John von Neumann had the fundamental insight that probability provides a way out of this conundrum.

Each player computes the probabilities so as to minimize the maximum expected point-loss independent of the opponent's strategy.

This minimax method can compute probably optimal strategies for all two-player zero-sum games.

The Nash equilibrium for a two-player, zero-sum game can be found by solving a linear programming problem.

The equilibrium mixed strategy for the minimizing player can be found by solving the dual of the given linear program.

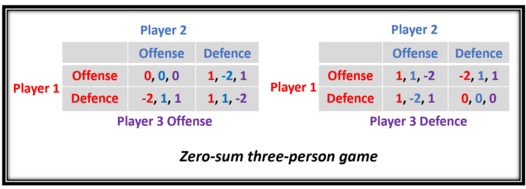

Copeland's review notes that an n-player non-zero-sum game can be converted into an (n+1)-player zero-sum game, where the n+1st player, denoted the fictitious player, receives the negative of the sum of the gains of the other n-players (the global gain / loss).

For example, if the number of new airlines departing from and arriving at the airport is the same, the economic contribution to the host city may be a zero-sum game.

Derivatives trading may be considered a zero-sum game, as each dollar gained by one party in a transaction must be lost by the other, hence yielding a net transfer of wealth of zero.

If the price of the underlying asset increases before the expiration date the buyer may exercise/ close the options/ futures contract.

The buyers gain and corresponding sellers loss will be the difference between the strike price and value of the underlying asset at that time.

Swaps, which involve the exchange of cash flows from two different financial instruments, are also considered a zero-sum game.

Whilst derivatives trading may be considered a zero-sum game, it is important to remember that this is not an absolute truth.

While some trades may result in a simple transfer of wealth from one party to another, the market as a whole is not purely competitive, and many transactions serve important economic functions.

[21] The primary goal of the stock market is to match buyers and sellers, but the prevailing price is the one which equilibrates supply and demand.

Stock prices generally move according to changes in future expectations, such as acquisition announcements, upside earnings surprises, or improved guidance.

In this scenario, all existing holders of Company C stock will enjoy gains without incurring any corresponding measurable losses to other players.

It has been theorized by Robert Wright in his book Nonzero: The Logic of Human Destiny, that society becomes increasingly non-zero-sum as it becomes more complex, specialized, and interdependent.