Competition between Airbus and Boeing

[2] The duopoly resulted from a series of mergers within the global aerospace industry, with Airbus beginning as a pan-European consortium while the American Boeing absorbed its former arch-rival, McDonnell Douglas, in 1997.

Other manufacturers, such as Lockheed Martin and Convair in the United States, and British Aerospace (now BAE Systems) and Fokker in Europe, were no longer able to compete and effectively withdrew from this market.

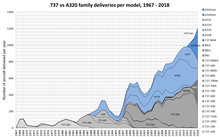

For the new re-engined variants, the 737 MAX series had 3,072 orders since its introduction in August 2011 and the A320neo family got 3,355 in the same time frame or in total 4,471 since its launch in December 2010.

[35] In October 2019, ultimately, the A320 family surpassed the Boeing 737 to become the highest-selling airliner with a total order of 15,193 and respectively 15,136 aircraft at the end of the month.

[38][39] To date, with its 21 years ahead of introduction, the 737 series aircraft had been delivered nearly 1,500 more than the A320 family and within the same time frame, the last had 49, slightly more deliveries than its competitor.

In November 2017, chief Willie Walsh said that International Airlines Group budget carrier Level benefited more from its two A330-200's lower cost of ownership than their 6t higher fuel burn ($3,500) on a Barcelona-Los Angeles flight; it planned to introduce three more as there weren't enough B787 pilots.

Rival performance claims by Airbus and Boeing appeared contradictory, their methodologies unclear, and neither validated by a third-party source.

[54] The A380-800 has 478 square metres (5,150 sq ft) of cabin floor space, 49% more than the 747-8, while commentators noted the "downright eerie" lack of engine noise, with the A380 being 50% quieter than a 747-400 on takeoff.

[60][61] At Farnborough in July 2016, Airbus announced that in a "prudent, proactive step", starting in 2018, it expected to deliver 12 A380 aircraft per year, down from 27 deliveries in 2015.

[70] The price was so low that some media sources believed Boeing would take a loss on the deal, also speculating that the company could perhaps break even with maintenance and spare parts contracts.

[72][73][74][clarification needed] Because many of the world's airlines are wholly or partially government-owned, aircraft procurement decisions are often taken according to political criteria in addition to commercial ones.

Boeing and Airbus seek to exploit this by subcontracting the production of aircraft components or assemblies to manufacturers in countries of strategic importance in order to gain a competitive advantage overall.

However, engine manufacturers prefer to be a single source and often succeed in striking commercial deals with Boeing and Airbus to achieve this.

Teal group's Richard Aboulafia notes that Boeing's pricing power for the 777-300ER was better when it was alone in its long-haul, large capacity twinjet market but this advantage dissipates with the A350-1000 coming.

[92] At the end of 2015, the sale and leaseback of new Airbus A350-900 from GECAS to Finnair value them at €132.5M ($144M)[93] In order to close the production gap between the B777 classic and the new 777X, Boeing is challenged by a $120m market price for the -300ERs.

Southwest Airlines, which uses the 737 for its entire fleet (680 in service or on order), said it was not prepared to wait 20 years or more for a new 737 model and threatened to convert to Airbus.

As of January 2024, the manufactures plan to increase the production of their models:[111][a] This shows the backlog for each year on December 31:[112][113] Figures in blue indicate a lead for Airbus.

[136] In July 2004, Harry Stonecipher (then CEO of Boeing) accused Airbus of abusing a 1992 bilateral EU-US agreement regarding large civil aircraft support from governments.

The agreement allows up to 33 percent of the program cost to be met through government loans which are to be fully repaid within 17 years with interest and royalties.

Airbus argues that pork barrel military contracts awarded to Boeing (the second largest US defense contractor) are in effect a form of subsidy (see the KC-X program).

[140] In January 2005, European Union and United States trade representatives Peter Mandelson and Robert Zoellick agreed to talks aimed at resolving increasing tensions.

[146] In two separate findings issued in May 2011, the WTO found, firstly, that the US defence budget and NASA research grants could not be used as vehicles to subsidise the civilian aerospace industry and that Boeing must repay $5.3 billion of illegal subsidies.

[147] Secondly, the WTO Appellate Body partly overturned an earlier ruling that European Government launch aid constituted unfair subsidy, agreeing with the point of principle that the support was not aimed at boosting exports and some forms of public-private partnership could continue.

[162] In September 2016, the WTO found that Airbus did not remedy the harm to Boeing from illegal subsidies, and the EU immediately appealed for a final decision in late spring 2018.

Boeing expected the 2016 decision would largely be upheld with sanctions of $10 to $15 billion, possibly levied by punitive US government tariffs, but that the EU would retaliate strongly.

[164] On 15 May 2018, in its EU appeal ruling, the WTO concluded that the A380 and A350 received improper subsidies through repayable launch aids or low interest rates, like previous airliners, which could have been avoided.

Boeing claimed victory but Airbus countered it is thin with 94% of the complaints rejected, as launch aids are legal but at market interest rates, not lower: violations will be corrected.

US tariffs, probably on other industries, may take up to 18 months to get WTO approval, but EU could retaliate over Washington State 787 subsidies and tax breaks for the 777X.

[183][184][185] On 11 October, acting European Commissioner for Trade Valdis Dombrovskis urged the US to withdraw its tariffs, reiterating retaliatory action.

[187] The next day, on 14 October, the US finally offered to remove their tariffs if Airbus would refinance the state loans at a level of interest that assumed a 50% product failure rate.