Annual percentage rate

[5][6] Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:[3] In some areas, the annual percentage rate (APR) is the simplified counterpart to the effective interest rate that the borrower will pay on a loan.

In many countries and jurisdictions, lenders (such as banks) are required to disclose the "cost" of borrowing in some standardized way as a form of consumer protection.

The (effective) APR has been intended to make it easier to compare lenders and loan options.

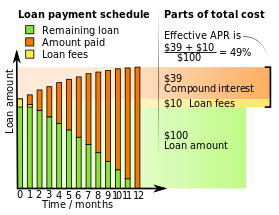

[9] Effective annual percentage rate can be computed in at least three ways: For example, consider a $100 loan which must be repaid after one month, plus 5%, plus a $10 fee.

In the United States, the Truth in Lending Act governs the calculation and disclosure of APR, implemented by the Consumer Financial Protection Bureau (CFPB) through Regulation Z.

In general, APR in the United States is expressed as the periodic (for instance, monthly) interest rate times the number of compounding periods in a year[10] (also known as the nominal interest rate); since the APR must include certain non-interest charges and fees, it requires more detailed calculation.

This information is typically mailed to the borrower and the APR is found on the truth in lending disclosure statement, which also includes an amortization schedule.

It states, if the final annual percentage rate APR is off by more than 0.125% from the initial GFE disclosure, then the lender must re-disclose and wait another three business days before closing on the transaction.

For a fixed-rate mortgage, the APR is thus equal to its internal rate of return (or yield) under an assumption of zero prepayment and zero default.

For an adjustable-rate mortgage the APR will also depend on the particular assumption regarding the prospective trajectory of the index rate.

A single method of calculating the APR was introduced in 1998 (directive 98/7/EC) and is required to be published for the major part of loans.

Using the improved notation of directive 2008/48/EC, the basic equation for calculation of APR in the EU is: In this equation the left side is the present value of the drawdowns made by the lender and the right side is the present value of the repayments made by the borrower.

In many cases the mortgage is not always paid back completely at the end of period N, but for instance when the borrower sells his house or dies.

If the $1000 one-time fees are taken into account then the yearly interest rate paid is effectively equal to 10.31%.

Despite the word "annual" in APR, it is not necessarily a direct reference for the interest rate paid on a stable balance over one year.

Note that a high U.S. APR of 29.99% compounded monthly carries an effective annual rate of 34.48%.

Because these fees are not included, some consumer advocates claim that the APR does not represent the total cost of borrowing.

Even beyond the non-included cost components listed above, regulators have been unable to completely define which one-time fees must be included and which excluded from the calculation.

With respect to items that may be sold with vendor financing, for example, automobile leasing, the notional cost of the good may effectively be hidden and the APR subsequently rendered meaningless.

Had the customer self-financed, a discounted sales price may have been accepted by the vendor; in other words, the customer has received cheap financing in exchange for paying a higher purchase price, and the quoted APR understates the true cost of the financing.

If the consumer pays the loan off early, the effective interest rate achieved will be significantly higher than the APR initially calculated.

In theory, this factor should not affect any individual consumer's ability to compare the APR of the same product (same repayment period and origination fees) across vendors.

Since the principal loan balance is not paid down during the interest-only term, assuming there are no set up costs, the APR will be the same as the interest rate.

[17] In a paper by Thomas W. Miller Jr. at the Mercatus Center, it is argued that while interest rate caps are often proposed as a means to combat "predatory" lending practices associated with high APRs on small-dollar loans, such regulatory measures overlook potential adverse effects.

This shift could effectively result in an implicit prohibition of products like payday loans by rendering them financially unsustainable.

[18] APR may not accurately reflect the cost of borrowing for certain mortgage types, such as those with non-standard repayment structures.

This discrepancy arises because APR is designed under the assumption of a standard loan structure, potentially misleading consumers about the financial implications of mortgages with variable rates, interest-only periods, or other unique features.

These excluded fees can include various types of non-interest charges such as certain closing costs, which are not reflected in the APR calculation.