Credit card debt

If the debt is not paid on time, the company will charge a late-payment penalty and report the late payment to credit rating agencies.

[citation needed] Consumers commonly pay off a large portion of their credit card debt in the first fiscal quarter of the year because this tends to be when people receive holiday bonuses and tax refunds.

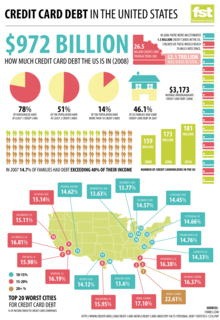

[12] According to the Federal Reserve Bank of New York, "the amount owed by all Americans on their credit cards increased to a record $1.13 trillion at the end of 2023".

[13] Wilbert van der Klaauw, a Fed economic research adviser, said growth in credit card debt shows "increased financial stress in younger and lower income families".

[14] After the start of the Great Recession in December 2007, multiple-credit-card debt-relief options became widely popular for U.S. residents with unsecured debt of over $5,000.

[15] As of 2024[update], credit card issuers are required to disclose to the customer how much money a balance will take to pay off if only the minimum payment is made on their billing statement.

Certain kinds of debt reviewed may be considered fraud if it is discovered a line of credit was used to make unusually large purchases or cash advances 60 days before the bankruptcy case was filed.

[citation needed] If the statute of limitations has passed in certain U.S. states and legal actions have not been issued against the debtor, a collection agency must remove the outstanding debt from their credit report.