Australian property bubble

[4] In June 2016, the Organisation for Economic Co-operation and Development (OECD) reported that Australia's housing boom could end in 'dramatic and destabilising' real estate hard landing.

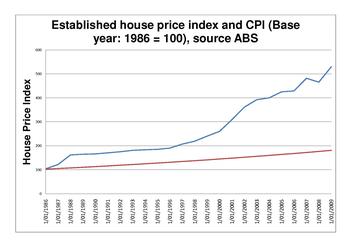

This indicates unsustainable growth in property, driven by ever higher debt levels fuelled by the RBA's then chief, Glenn Stevens who began cutting rates beginning in 2011.

Presently the Reserve Bank of Australia has maintained for some time a low cash interest rate policy which has also reduced the cost of financing property purchase.

One senior economist noted "The index ignores price changes in the single biggest purchase a person (or household) is likely to make in their lifetime – a dwelling″.

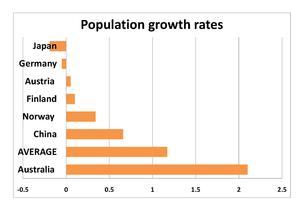

[18] A number of economists, such as Macquarie Bank analyst Rory Robertson, assert that high immigration and the propensity of new arrivals to cluster in the capital cities is exacerbating the nation's housing affordability problem.

28 First Home Ownership (2004) also stated, in relation to housing, "that Growth in immigration since the mid-1990s has been an important contributor to underlying demand, particularly in Sydney and Melbourne.

"[21] This has been exacerbated by Australian lenders relaxing credit guidelines for temporary residents, allowing them to buy a home with a 10% deposit.

The RBA in its submission to the same PC Report also stated "rapid growth in overseas visitors such as students may have boosted demand for rental housing".

The "ABS population growth figures omit certain household formation groups – namely, overseas students and business migrants who do not continuously stay for 12 months in Australia.

"[21] This statistical omission lead to the admission: "The Commission recognises that the ABS resident population estimates have limitations when used for assessing housing demand.

Given the significant influx of foreigners coming to work or study in Australia in recent years, it seems highly likely that short-stay visitor movements may have added to the demand for housing.

The commission's report entitled "First Home Ownership"[27] observed inter alia that "general taxation arrangements [capital gains tax, negative gearing, capital works deductions and depreciation provisions] have lent impetus to the recent surge in investment in rental housing and consequent house price increases.

"[citation needed] The government's response to the report stated that "There is no conclusive evidence that the tax system has had a significant impact on house prices.