Dot-com bubble

While some online entertainment and news outlets failed when their seed capital ran out, others persisted and eventually became economically self-sufficient.

The sites that survived and eventually prospered after the bubble burst had two things in common: a sound business plan, and a niche in the marketplace that was, if not unique, particularly well-defined and well-served.

[citation needed] In the aftermath of the dot-com bubble, telecommunications companies had a great deal of overcapacity as many Internet business clients went bust.

[citation needed] During this time, a handful of companies found success developing business models that helped make the World Wide Web a more compelling experience.

[9] While some of the new entrepreneurs had experience in business and economics, the majority were simply people with ideas, and did not manage the capital influx prudently.

But despite this, the Internet continued to grow, driven by commerce, ever greater amounts of online information, knowledge, social networking and access by mobile devices.

[15] The Taxpayer Relief Act of 1997, which lowered the top marginal capital gains tax in the United States, also made people more willing to make more speculative investments.

[18] As a result of these factors, many investors were eager to invest, at any valuation, in any dot-com company, especially if it had one of the Internet-related prefixes or a ".com" suffix in its name.

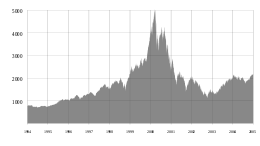

[19] A combination of rapidly increasing stock prices in the quaternary sector of the economy and confidence that the companies would turn future profits created an environment in which many investors were willing to overlook traditional metrics, such as the price–earnings ratio, and base confidence on technological advancements, leading to a stock market bubble.

[20] An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to trade on the financial market were common.

[21] The news media took advantage of the public's desire to invest in the stock market; an article in The Wall Street Journal suggested that investors "re-think" the "quaint idea" of profits,[22] and CNBC reported on the stock market with the same level of suspense as many networks provided to the broadcasting of sports events.

[19][page needed] The most successful entrepreneurs, such as Mark Cuban, sold their shares or entered into hedges to protect their gains.

Sir John Templeton successfully shorted many dot-com stocks at the peak of the bubble during what he called "temporary insanity" and a "once-in-a-lifetime opportunity".

[26][27] The "growth over profits" mentality and the aura of "new economy" invincibility led some companies to engage in lavish spending on elaborate business facilities and luxury vacations for employees.

[18] Spectrum auctions for 3G in the United Kingdom in April 2000, led by Chancellor of the Exchequer Gordon Brown, raised £22.5 billion.

[34][35] When financing became difficult to obtain as the bubble burst, high debt ratios of some companies led to a number of bankruptcies.

[42][43] Meanwhile, Alan Greenspan, then Chair of the Federal Reserve, raised interest rates several times; these actions were believed by many[weasel words] to have caused the bursting of the dot-com bubble.

[46] However, on March 13, 2000, news that Japan had once again entered a recession triggered a global sell off that disproportionately affected technology stocks.

[50] The next day, the Federal Reserve raised interest rates, leading to an inverted yield curve, although stocks rallied temporarily.

[52] That same day, Bloomberg News published a widely read article that stated: "It's time, at last, to pay attention to the numbers".

[26] Several companies and their executives, including Bernard Ebbers, Jeffrey Skilling, and Kenneth Lay, were accused or convicted of fraud for misusing shareholders' money, and the U.S. Securities and Exchange Commission levied large fines against investment firms including Citigroup and Merrill Lynch for misleading investors.

[71] As growth in the technology sector stabilized, companies consolidated; some, such as Amazon.com, eBay, Nvidia and Google gained market share and came to dominate their respective fields.

Meaning that you need some of this mania to cause investors to open up their pocketbooks and finance the building of the railroads or the automobile or aerospace industry or whatever.