Australian property market

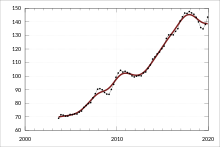

House prices in Australia receive considerable attention from the media and the Reserve Bank[2] and some commentators have argued that there is an Australian property bubble.

[4] However, with stricter credit policy and reduced interest from foreign investors in residential property, prices have started falling in all the major cities.

[16] Foreign investment has also been identified as a key driver of affordability issues, with recent years seeing particularly high capital inflows from Chinese investors.

[17] A number of economists, such as Macquarie Bank analyst Rory Robertson, assert that high immigration and the propensity of new arrivals to cluster in the capital cities is exacerbating the nation's housing affordability problem.

The RBA in its submission to the same PC Report also stated "rapid growth in overseas visitors such as students may have boosted demand for rental housing".

The "ABS population growth figures omit certain household formation groups – namely, overseas students and business migrants who do not continuously stay for 12 months in Australia.

"[20] This statistical omission lead to the admission: "The Commission recognises that the ABS resident population estimates have limitations when used for assessing housing demand.

Given the significant influx of foreigners coming to work or study in Australia in recent years, it seems highly likely that short-stay visitor movements may have added to the demand for housing.

Negative gearing receives considerable media and political attention due to the perceived distortion it creates on residential property prices.

[32] The COVID-19 pandemic also impacted the rental market with shared households reducing in size and city workers moving to regional areas due to increased remote work.