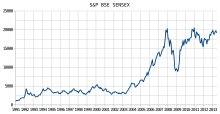

BSE SENSEX

The market capitalisation of a company is determined by multiplying the price of its stock by the number of shares issued by corporate actions, replacement of scrips.

On 27 July 2007 the SENSEX witnessed a huge decline because of selling by Foreign Institutional Investors and global cues to come back to 15,160 points by noon.

Following global cues and heavy selling in the international markets, the BSE SENSEX fell by 615 points in a single day on 1 August 2007.

[64] On 16 October 2007, SEBI (Securities & Exchange Board of India) proposed curbs on participatory notes which accounted for roughly 50% of FII investment in 2007.

Within a minute of opening trade, the SENSEX crashed by 1,744 points or about 9% of its value – the biggest intra-day fall in Indian stock markets in absolute terms until then.

Finance Minister P. Chidambaram issued clarifications, in the meantime, that the government was not against FIIs and was not immediately banning PNs.

After detailed clarifications from the SEBI chief M. Damodaran regarding the new rules, the market made an 879-point gain on 23 October, thus signalling the end of the PN crisis.

The SENSEX plunged by 869.65 points on 6 July 2009, the day of Union Budget presentation in Parliament on concerns over high fiscal deficit.

The SENSEX recovered to close at 17,605.40 after it tumbled to the day's low of 16,963.96, on high volatility as investors panicked following weak global cues amid fears of a recession in US.

[66] Over the course of two days, the BSE SENSEX in India dropped from 19,013 on Monday morning to 16,730 by Tuesday evening or a two-day fall of 13.9%.

[66] Less than a month later, on 11 February 2008, the SENSEX lost 833.98 points, when Reliance Power fell below its IPO price in its debut trade after a high-profile public offer.

[32] The month ended with the SENSEX shedding 726.85 points on 31 March 2008, after heavy selling in blue-chip stocks on global economic fears.

[70] On Friday, 13 March, trading was halted for 45 minutes for the first time in 12 years since January 2008 due to lower circuit.

[72] Continuing the losing streak, wealth worth ₹14.22 lakh crore ($200 Billion) was erased on 23 March 2020 as BSE SENSEX lost 3,934.72 points to end at 25,981.24.

[citation needed] On the following dates, the SENSEX index suffered major single-day falls at close (of 430 or more points):[74] Tax cut buzz.