Behavioral economics

[9] There was a lack of confidence in hedonic theories, which saw pursuance of maximum benefit as an essential aspect in understanding human economic behavior.

[11][12] To boost the ability of economics to predict accurately, economists started looking to tangible phenomena rather than theories based on human psychology.

In challenging the accuracy of generic utility, these concepts established a practice foundational in behavioral economics: Building on standard models by applying psychological knowledge.

Behavioral economists engage in mapping the decision shortcuts that agents use in order to help increase the effectiveness of human decision-making.

A widely cited proposal from Sunstein and Thaler urges that healthier food be placed at sight level in order to increase the likelihood that a person will opt for that choice instead of less healthy option.

Its main feature was that it allowed for non-linear probability weighting in a cumulative manner, which was originally suggested in John Quiggin's rank-dependent utility theory.

Fast thinking utilises heuristics, which is a decision-making process that undertakes shortcuts, and rules of thumb to provide an immediate but often irrational and imperfect solution.

[30] The first formulation of the term and associated principles was developed in cybernetics by James Wilk before 1995 and described by Brunel University academic D. J. Stewart as "the art of the nudge" (sometimes referred to as micronudges[31]).

It also drew on methodological influences from clinical psychotherapy tracing back to Gregory Bateson, including contributions from Milton Erickson, Watzlawick, Weakland and Fisch, and Bill O'Hanlon.

[34] Thaler and Sunstein defined their concept as:[35] A nudge, as we will use the term, is any aspect of the choice architecture that alters people's behavior in a predictable way without forbidding any options or significantly changing their economic incentives.

In other words, a nudge alters the environment so that when heuristic, or System 1, decision-making is used, the resulting choice will be the most positive or desired outcome.

Nudge theory has also been applied to business management and corporate culture, such as in relation to health, safety and environment (HSE) and human resources.

[50][51] Behavioral economists such as Bob Sugden have pointed out that the underlying normative benchmark of nudging is still homo economicus, despite the proponents' claim to the contrary.

[72] Connected to this concept is the endowment effect, a theory that people value things more if they own them - they require more to give up an object than they would be willing to pay to acquire it.

Originally published in 1841, MacKay's Extraordinary Popular Delusions and the Madness of Crowds presents a chronological timeline of the various panics and schemes throughout history.

The foundation of behavioral finance is an area based on an interdisciplinary approach including scholars from the social sciences and business schools.

[80] It is argued that the cause is entry barriers (both practical and psychological) and that the equity premium should reduce as electronic resources open up the stock market to more traders.

Experiments include testing deviations from typical simplifications of economic theory such as the independence axiom[86] and neglect of altruism,[87] fairness,[88] and framing effects.

Tshilidzi Marwala and Evan Hurwitz in their book,[101] studied the utility of behavioral economics in such situations and concluded that these intelligent machines reduce the impact of bounded rational decision making.

Ernst Fehr, Armin Falk, and Rabin studied fairness, inequity aversion and reciprocal altruism, weakening the neoclassical assumption of perfect selfishness.

The Silicon Valley–based start-up Singularities is using the AGM postulates proposed by Alchourrón, Gärdenfors, and Makinson—the formalization of the concepts of beliefs and change for rational entities—in a symbolic logic to create a "machine learning and deduction engine that uses the latest data science and big data algorithms in order to generate the content and conditional rules (counterfactuals) that capture customer's behaviors and beliefs.

CHIBE researchers have found evidence that many behavioral economics principles (incentives, patient and clinician nudges, gamification, loss aversion, and more) can be helpful to encourage vaccine uptake, smoking cessation, medication adherence, and physical activity, for example.

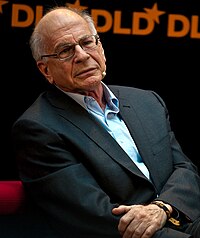

"[114][115] Thaler was especially recognized for presenting inconsistencies in standard Economic theory and for his formulation of mental accounting and Libertarian paternalism[116][117] The work of Andrei Shleifer focused on behavioral finance and made observations on the limits of the efficient market hypothesis.

[7] Mullainathan's research focused on the salaries of executives on Wall Street; he also has looked at the implications of racial discrimination in markets in the United States.

[128] It is noteworthy that in the episode of EconTalk in which Taleb said this, he and the host, Russ Roberts discuss the significance of Gary Becker's 1962 paper cited in the first paragraph in this section as an argument against any implications which can be drawn from one shot psychological experiments on market level outcomes outside of laboratory settings, i.e. in the real world.

Others argue that decision-making models, such as the endowment effect theory, that have been widely accepted by behavioral economists may be erroneously established as a consequence of poor experimental design practices that do not adequately control subject misconceptions.

[133] Matthew Rabin[134] dismisses these criticisms, countering that consistent results typically are obtained in multiple situations and geographies and can produce good theoretical insight.

Data collected in experiments are used to estimate effect size, test the validity of economic theories, and illuminate market mechanisms.

[142] Neuroeconomics is an interdisciplinary field that seeks to explain human decision making, the ability to process multiple alternatives and to follow a course of action.

Thus, when living at subsistence level where a reduction of resources may result in death, it may have been rational to place a greater value on preventing losses than on obtaining gains.