Biomedical research in the United States

[1] The National Institutes of Health (NIH) are considered the government's flagship biomedical research funding organization.

It is thus vital to pinpoint the right biological targets (genes, proteins and other molecules) early in the process, so as to design more rational drugs and better tailored therapies.

The 21st Century Cures Act was signed into law on 13 December 2016, a year after the release of the UNESCO Science Report.

This provision has proven controversial, with doctors cautioning that overreliance on biomarkers as a measure of efficacy can be misleading, as they may not always reflect improved patient outcomes.Another government scheme hopes to increase the number of new diagnostics and therapies for patients, while reducing the time and cost of developing these.

At the launch of the Accelerating Medicines Partnership in February 2014, NIH director Francis S. Collins stated that "Currently, we are investing too much money and time in avenues that don't pan out, while patients and their families wait."

[1] The partnership involves the National Institutes of Health (NIH) and the Food and Drug Administration (FDA), as well as 10 major biopharmaceutical companies and several non-profit organizations like the Alzheimer's Association.

One critical component is that industry partners have agreed to make the data and analyses arising from the partnership accessible to the broad biomedical community.

The goal of this project is to leverage genetic, optical and imaging technologies to map individual neurons and complex circuits in the brain, eventually leading to a more complete understanding of this organ's structure and function.

In his 2016 budget request, the president asked for US$215 million to be shared by the NIH, National Cancer Institute and FDA to fund the Precision Medicine Initiative.

** Although incorporated in the Netherlands, Airbus's principal manufacturing facilities are located in France, Germany, Spain and the UK.

The National Venture Capital Association has reported that, in 2014, venture capital investment in the life sciences was at its highest level since 2008: in biotechnology, $6.0 billion was invested in 470 deals and, in life sciences overall, $8.6 billion in 789 deals (including biotechnology and medical devices).

[1] The Organisation for Economic Cooperation and Development estimates that venture capital investment in the United States had fully recovered by 2014.

[3] In recent years, a number of pharmaceutical companies have made strategic mergers to relocate their headquarters overseas to gain a tax advantage, including Medtronic and Endo International.

"About 31% of this spending went on specialty drug therapies to treat inflammatory conditions, multiple sclerosis, oncology, hepatitis C and HIV, etc., and 6.4% on traditional therapies to treat diabetes, high cholesterol, pain, high blood pressure and heart disease, asthma, depression and so on.

Several pharmaceutical companies have made strategic mergers in recent years to relocate their headquarters overseas to order to gain a tax advantage.

Zarxio is a biosimilar of the cancer drug Neupogen, which boosts the patient's white blood cells to ward off infection.

A 2014 study by the Rand Institute estimates a range of US$13–66 billion in savings over 2014–2024, depending upon the level of competition and FDA regulatory approval patterns.

[1] Observers foresee the further development and emergence of wearable health monitoring devices, telediagnosis and telemonitoring, robotics, biosensors, three-dimensional (3D) printing, new in vitro diagnostic tests and mobile apps that enable users to monitor their health and related behaviour better.

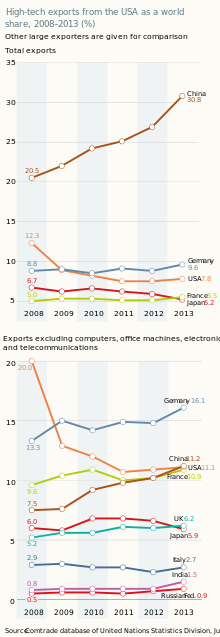

Even computing and communications equipment is now assembled in China and other emerging economies, with high-tech value-added components being produced elsewhere.

Within the United States' scientific industries active in research, 9.1% of products and services are concerned with the licensing of intellectual property rights.