Bond (finance)

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the maturity date and interest (called the coupon) over a specified amount of time.

[1]) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds.

This means they will be repaid in advance of stockholders, but will rank behind secured creditors, in the event of bankruptcy.

This means that once the transfer agents at the bank medallion-stamp the bond, it is highly liquid on the secondary market.

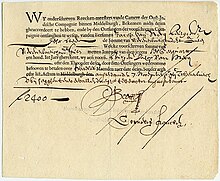

The use of the word "bond" in this sense of an "instrument binding one to pay a sum to another" dates from at least the 1590s.

The security firm takes the risk of being unable to sell on the issue to end investors.

The bookrunner is listed first among all underwriters participating in the issuance in the tombstone ads commonly used to announce bonds to the public.

[5] The terms of the bond, such as the coupon, are fixed in advance and the price is determined by the market.

[6] Historically, an alternative practice of issuance was for the borrowing government authority to issue bonds over a period of time, usually at a fixed price, with volumes sold on a particular day dependent on market conditions.

As long as all due payments have been made, the issuer has no further obligations to the bond holders after the maturity date.

The maturity can be any length of time, although debt securities with a term of less than one year are generally designated money market instruments rather than bonds.

In the market for United States Treasury securities, there are four categories of bond maturities: The coupon is the interest rate that the issuer pays to the holder.

Interest can be paid at different frequencies: generally semi-annual (every six months) or annual.

The net proceeds that the issuer receives are thus the issue price, less issuance fees.

A downside is that the government loses the option to reduce its bond liabilities by inflating its domestic currency.

These can be issued by foreign issuers looking to diversify their investor base away from domestic markets.

The market price of a bond may be quoted including the accrued interest since the last coupon date.

(Some bond markets include accrued interest in the trading price and others add it on separately when settlement is made.)

These factors are likely to change over time, so the market price of a bond will vary after it is issued.

Insurance companies and pension funds have liabilities which essentially include fixed amounts payable on predetermined dates.

Thus, bonds are generally viewed as safer investments than equities, but this perception is only partially correct.

Bonds are often liquid – it is often fairly easy for an institution to sell a large quantity of bonds without affecting the price much, which may be more difficult for equities – and the comparative certainty of a fixed interest payment twice a year and a fixed lump sum at maturity is attractive.

Bondholders also enjoy a measure of legal protection: under the law of most countries, if a company goes bankrupt, its bondholders will often receive some money back (the recovery amount), whereas the company's equity stock often ends up valueless.

This can be damaging for professional investors such as banks, insurance companies, pension funds and asset managers (irrespective of whether the value is immediately "marked to market" or not).

One way to quantify the interest rate risk on a bond is in terms of its duration.

As an example, after an accounting scandal and a Chapter 11 bankruptcy at the giant telecommunications company Worldcom, in 2004 its bondholders ended up being paid 35.7 cents on the dollar.

A number of bond indices exist for the purposes of managing portfolios and measuring performance, similar to the S&P 500 or Russell Indexes for companies' shares.