Bond market

The yield on government bonds in low risk countries such as the United States and Germany is thought to indicate a risk-free rate of default.

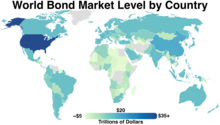

Amounts outstanding on the global bond market increased by 2% in the twelve months to March 2012 to nearly $100 trillion.

Growth of the market since the start of the economic slowdown was largely a result of an increase in issuance by governments.

[5] According to the Securities Industry and Financial Markets Association (SIFMA),[6] as of Q1 2017, the U.S. bond market size is (in billions): The total federal government debts recognized by SIFMA are significantly less than the total bills, notes and bonds issued by the U.S. Treasury Department,[7] of some $19.8 trillion at the time.

This figure is likely to have excluded the inter-governmental debts such as those held by the Federal Reserve and the Social Security Trust Fund.

When interest rates increase, the value of existing bonds falls, since new issues pay a higher yield.

Likewise, when interest rates decrease, the value of existing bonds rises, since new issues pay a lower yield.

Economists' views of economic indicators versus actual released data contribute to market volatility.

If the economic release differs from the consensus view, the market usually undergoes rapid price movement as participants interpret the data.

These securities allow individual investors the ability to overcome large initial and incremental trading sizes.

A number of bond indices exist for the purposes of managing portfolios and measuring performance, similar to the S&P 500 or Russell Indexes for stocks.

The most common American benchmarks are the Barclays Capital Aggregate Bond Index, Citigroup BIG and Merrill Lynch Domestic Master.

[9] Loans were made at a customary fixed 20% interest rate; this custom was continued in Babylon, Mesopotamia and written into the Code of Hammurabi.

In these ancient times, loans were initially made in cattle or grain from which interest could be paid from growing the herd or crop and returning a portion to the lender.

[dubious – discuss] Silver became popular as it was less perishable and allowed large values to be transported more easily, but unlike cattle or grain could not naturally produce interest.

[12] By the Plantagenet era, the English Crown had long-standing links with Italian financiers and merchants such as Riccardi of Lucca in Tuscany.

[22] Following the Hundred Years' War, monarchs of England and France defaulted on very large debts to Venetian bankers causing a collapse of the system of Lombard banking in 1345.

Each maturity of bond (one-year, two-year, five-year and so on) was thought of as a separate market until the mid-1970s when traders at Salomon Brothers began drawing a curve through their yields.

This innovation - the yield curve - transformed the way bonds were both priced and traded and paved the way for quantitative finance to flourish.