Affordability of housing in the United Kingdom

For owner-occupied properties, key determinants of affordability are house prices, income, interest rates, and purchase costs.

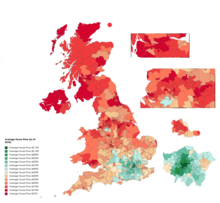

[3][4][5] Land Registry figures for England and Wales show that housing prices rose from £70,000 to £224,000 in the 20 years between 1998 and 2018.

[10] A report by the Adam Smith Institute found that by using 4% of London's green belt, one million homes could be built within a 10-minute walk of a railway station.

It noted that if general inflation had risen as fast as housing prices had since 1971, a chicken would cost £51; and that Britain is "building less homes today than at any point since the 1920s".

We know from our research that three-quarters (79%) of the population would like to see more trees planted and more food grown in the areas around towns and cities.

[20] Stamp duty land tax (SDLT) is payable on property transactions in England and Northern Ireland.

[24] In April 2013, The Daily Telegraph reported that research by Moneyfacts showed the average mortgage arrangement fee to be £1522.

[28] In a government briefing paper, 'Tackling the under-supply of housing in England',[29] Barton and Wilson describe England's housing need as being illustrated by issues "such as increased levels of overcrowding, acute affordability issues, more young people living with their parents for longer periods, impaired labour mobility resulting in businesses finding it difficult to recruit and retain staff, and increased levels of homelessness".

[33][34][35] In 2015, the Bow Group, a conservative think-tank, produced a report suggesting a reduction in international investment demand of property.

The report proposed limiting foreign residents to the purchase of single new-build properties, with penalties if sold within five years.

[36] In 2016, London mayor Sadiq Khan launched an inquiry into housing costs in the city, also highlighting the effect of foreign investment.

[37] The government set up a £60 million fund to help councils deal with high levels of second home ownership.

[39] From April 2016, a stamp duty surcharge of three per cent of the purchase price was required for those buying to let.

From April 2017, buy-to-let mortgage interest payments will have higher rates of income tax relief phased out by the government.

[43] Research from Trust for London found that 24% of new housing completions in the three years to 2015/16 were affordable, which represented 21,500 homes.