Budget constraint

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within their given income.

The concept of soft budget constraint is commonly applied to economies in transition.

It was used to explain the "economic behavior in socialist economies marked by shortage”.

[2] In the socialist transition economy there are soft budget constraint on firms because of subsidies, credit and price support.

[3] This theory implies that the survival of a firm depends on financial assistance, especially in a socialist country.

The soft budget constraint syndrome usually occurs in the paternalistic role of the State in economic organizations, such as public and private companies and non-profit organizations.

János Kornai also highlighted that there are five dimensions to evaluate the post-socialist transition, including fiscal subsidy, soft taxation, soft bank credit (non-performing loans), soft trade credit (the accumulate rears between firms) and wage arrears.

[4] According to the point of view by Cllower [1965],[5] budget constraints are a rational planning assumption with two main attributes.

The first is that budget constraints refer to the decision makers' behavioural characteristics --- selling output or acquiring asset income to compensate for spending.

The reason for the soft budget constraints is that the excess of expenditure over income will be paid by additional organizations (the State).

In addition, the decision maker expects such external financial assistance to be highly probable based on his actions.

The further explanation is the more excess spending is covered by external aid, the budget constraints will be more softer.

[6] Dewatripont and Maskin(1995) point out the presence of sunk costs in existing loans may lead to soft budget constraints when banks need additional financial assistance.

Through investment screening and monitoring technology, banks can improve the relative profitability of new loans, thus breaking the equilibrium of soft budget constraints.

As consumers are insatiable, and utility functions grow with quantity, the only thing that limits our consumption is our own budget.

[8] In general, the budget set (all bundle choices that are on or below the budget line) represents all possible bundles of goods an individual can afford given their income and the prices of goods.

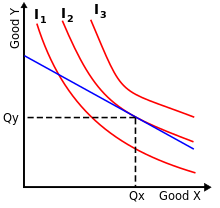

When behaving rationally, an individual consumer should choose to consume goods at the point where the most preferred available indifference curve on their preference map is tangent to their budget constraint.

The tangent point (the xy coordinate) represents the amount of goods x and y the consumer should purchase to fully utilize their budget to obtain maximum utility.

[9] It is important to note that the optimal consumption bundle will not always be an interior solution.

If the solution to the optimality condition leads to a bundle that is not feasible, the consumer's optimal bundle will be a corner solution which suggests the goods or inputs are perfect substitutes.

A line connecting all points of tangency between the indifference curve and the budget constraint is called the expansion path.

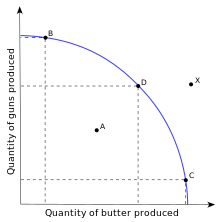

A production-possibility frontier is a constraint in some ways analogous to a budget constraint, showing limitations on a country's production of multiple goods based on the limitation of available factors of production.

However, the benefits of international trade are generally demonstrated through allowance of a shift in the consumption-possibility frontiers of each trade partner which allows access to a more appealing indifference curve.

In the "toolbox" Hecksher-Ohlin and Krugman models of international trade, the budget constraint of the economy (its CPF) is determined by the terms-of-trade (TOT) as a downward-sloped line with slope equal to those TOTs of the economy.

While low-level demonstrations of budget constraints are often limited to less than two good situations which provide easy graphical representation, it is possible to demonstrate the relationship between multiple goods through a budget constraint.

is the total amount that may be spent, then the budget constraint is: Further, if the consumer spends his income entirely, the budget constraint binds: In this case, the consumer cannot obtain an additional unit of good

Budget constraints can be expanded outward or contracted inward through borrowing and lending.

[1] According to behavioral economics, choices on borrowing and lending may also be affected by Present bias.