Bullwhip effect

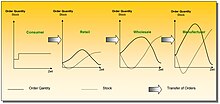

In part, this results in increasing swings in inventory in response to shifts in consumer demand as one moves further up the supply chain.

[2] Research at Stanford University helped incorporate the concept into supply chain vernacular using a story about Volvo.

This sequence of events is well simulated by the beer distribution game which was developed by MIT Sloan School of Management in the 1960s.

However, studies suggest that people with increased need for safety and security seem to perform worse than risk-takers in a simulated supply chain environment.

They established a list of four major factors which cause the bullwhip effect: demand signal processing, rationing game, order batching, and price variations.

In spite of having safety stocks there is still the hazard of stock-outs which result in poor customer service and lost sales.

In addition to the (financially) hard measurable consequences of poor customer services and the damage to public image and loyalty, an organization has to cope with the ramifications of failed fulfillment which may include contractual penalties.

Moreover, repeated hiring and dismissal of employees to manage the demand variability induces further costs due to training and possible lay-offs.

The impact of the bullwhip effect has been especially acute at the beginning stages of the COVID-19 pandemic, when sudden spikes in demand for everything from medical supplies such as masks or ventilators[13] to consumer items such as toilet paper or eggs created feedback loops of panic buying, hoarding, and rationing.

Individual Wal-Mart stores transmit point-of-sale (POS) data from the cash register back to corporate headquarters several times a day.

Specifically, they create an agent-based supply network simulation model capturing the behaviours of companies with asymmetric power dynamics with their partners.

To remain operational, they maximise their liquidity by negotiating longer repayment terms and cheaper financing, thus distributing risk onto weaker companies and propagating financial stress.