Carbon emission trading

[2]: 12 However, such schemes are usually not harmonized with defined carbon budgets that are required to maintain global warming below the critical thresholds of 1.5 °C or "well below" 2 °C, with oversupply leading to low prices of allowances with almost no effect on fossil fuel combustion.

Under such programmes, a national or international authority allocates permits to individual companies based on established criteria, with a view to meeting targets at the lowest overall economic cost.

Carbon emission trading began in Rio de Janeiro in 1992, when 160 countries agreed the UN Framework Convention on Climate Change (UNFCCC).

[17] A 2019 study by the American Council for an Energy Efficient Economy finds that efforts to put a price on greenhouse gas emissions are growing in North America.

[19] Economists generally agree that to regulate emissions efficiently, all polluters need to face the full marginal social costs of their actions.

[24][25][26][27] Carbon offset and credit programs provide a mechanism for countries to meet their Nationally Determined Contributions (NDC) commitments to achieve the goals of the Paris Agreement.

[32] These include claims of overestimated carbon sequestration, double-counting of credits, and the failure of projects to provide additional environmental benefits beyond what would have occurred naturally.

To mitigate carbon leakage and its effects on the environment, policymakers need to harmonize international climate policies and provide incentives to prevent companies from relocating production to regions with more lenient environmental regulations.

[41] Another economically efficient solution to carbon leakage is border adjustment,[42] where tariffs are set on imported goods from less regulated countries.

[44] The Paris Agreement provided a legal base for the creation of a global carbon market, which has a potentially significant role in stopping climate change.

However, if a firm sells the same amount of output as before that cap, with no change in production technology, the full value of permits received for free becomes windfall profits.

[41] Garnaut also noted that the complexity of free allocation and the large amounts of money involved encourage non-productive rent-seeking behaviour and lobbying of governments — activities that dissipate economic value.

[60] The International Air Transport Association, whose 230 member airlines comprise 93% of all international traffic, argue that emissions levels should be based on industry averages rather than using individual companies' previous emissions levels to set their future permit allowances, stating that "would penalise airlines that took early action to modernise their fleets, while a benchmarking approach, if designed properly, would reward more efficient operations".

[65] Garnaut stated that full auctioning will provide greater transparency and accountability and lower implementation and transaction costs as governments retain control over the permit revenue.

[41] Auctions of units are more flexible in distributing costs, provide more incentives for innovation, lessen the political arguments over the allocation of economic rents, and reduce tax distortions.

[66] Recycling of revenue from permit auctions could also offset a significant proportion of the economy-wide social costs of a cap and trade scheme.

[75] Some groups have claimed that non-existent emission reductions can be recorded under the Kyoto Protocol due to the surplus of allowances that some countries possess.

[79] The Financial Times published an article about cap-and-trade systems, which argued that "Carbon markets create a muddle" and "...leave much room for unverifiable manipulation".

[80] Emissions trading schemes have also been criticised for the potential of creating a new speculative market through the commodification of environmental risks through financial derivatives.

[82] In China, some companies started artificial production of greenhouse gases with sole purpose of recycling and gaining carbon credits.

[83][84] Corporate and governmental carbon emission trading schemes have been modified in ways that have been attributed to permitting money laundering to take place.

[88] Prior to the 2007 federal election, both the incumbent Howard Coalition government and the Rudd Labor opposition promised to implement an emissions trading scheme (ETS).

The new Rudd government introduced the Carbon Pollution Reduction Scheme, which the Liberal Party of Australia (now led by Malcolm Turnbull) supported.

The fixed price lent itself to characterisation as a "carbon tax", and when the government proposed the Clean Energy Bill in February 2011,[91] the opposition denounced it as a broken election promise.

The effort to start a national trading system has faced some problems that took longer than expected to solve, mainly in the complicated process of initial data collection to determine the base level of pollution emission.

[103] According to the initial design, there will be eight sectors that are first included in the trading system: chemicals, petrochemicals, iron and steel, non-ferrous metals, building materials, paper, power and aviation, but many of the companies involved lacked consistent data.

[117] Emitters had to cut their emissions by 6% or 8% depending on the type of organization; from 2011, those who exceed their limits were required to buy matching allowances, or invest in renewable-energy certificates, or offset credits issued by smaller businesses or branch offices.

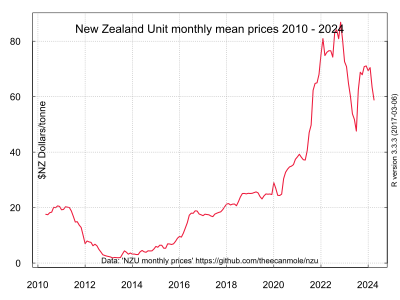

The NZ ETS was until 2015 highly linked to international carbon markets as it allowed unlimited importing of most of the Kyoto Protocol emission units.

[143] President Barack Obama's proposed 2010 United States federal budget wanted to support clean energy development with a 10-year investment of US$15 billion per year, generated from the sale of greenhouse gas emissions credits.

Failing to get congressional approval for such a scheme, President Barack Obama instead acted through the United States Environmental Protection Agency to attempt to adopt the Clean Power Plan, which does not feature emissions trading.