Child tax credit (United States)

[4][5][6] Research indicates that cash transfers to families, like the refundable portion of the CTC, lead to improved math and reading test scores, a higher likelihood of high school graduation, higher college attendance, and long-term increases in income for both parents and children.

Initially a small $500 per child nonrefundable credit, it was progressively made larger and extended to more taxpayers through subsequent legislation.

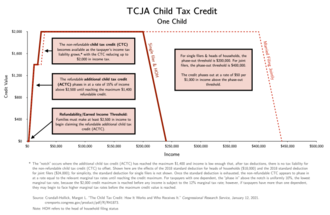

The Congressional Research Service estimates that about 1 in 5 taxpayers with eligible children fall into the phase-in range (i.e. they had incomes too low to receive the maximum credit).

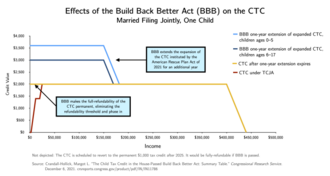

[14] The child tax credit was substantially expanded for one year under the American Rescue Plan Act of 2021 (ARP), a stimulus bill passed during the economic downturn caused by the COVID-19 pandemic.

Unless extended, the credit will revert to the CTC made permanent by the American Taxpayer Relief Act of 2012 (ATRA).

Under the ATRA, the CTC is a $1,000 non-refundable credit that begins to phase out at a rate of $50 for every $1,000 of income above $75,000 for single filers and unmarried heads of households or $110,000 for married couples filing jointly.

The ACTC has a refundability threshold of $3,000 (i.e. families must make at least $3,000 to claim the credit) and phases in at a rate of 15% of earned income above $3,000.

The Tax Cuts and Jobs Act of 2017 restricted the credit to only those dependent children possessing a Social Security Number (SSN); previously, dependents who did not possess a SSN because of their immigration status could still be eligible for the credit using an Individual Taxpayer Identification Number (ITIN).

[3] According to the Center on Budget and Policy Priorities, in 2018 the CTC, in conjunction with the earned income tax credit (EITC), lifted 5.5 million children above the poverty line.

[23] Research indicates that income from the CTC and EITC leads to improved educational outcomes for young children in low-income households and is associated with decreased child behavioral problems and significant increases in college attendance among high school seniors in low-income families.

[4][5][6][f] Evidence on cash transfers, like the refundable portion of the CTC, shows that children in families receiving them have improved math and reading test scores, a higher likelihood of high school graduation, and a 1–2% increase in earnings in adulthood;[8] they also lead to "persistent" increases in parents' earned income.

[26][27][28][29][30] Two surveys of people who claimed the 2021 expanded child tax credit, one by the United States Census Bureau and another by the University of Michigan in collaboration with Propel, a technology firm, found that most families used the monthly CTC payments to pay for basic needs like food, rent, school supplies, utilities, and clothing, as well as to reduce personal debt.

[39][40] Initially it was a $500-per-child (up to age 16) nonrefundable credit intended to provide tax relief to middle- and upper-middle-income families.

According to Margot L. Crandall-Hollick, a specialist in public finance, the bill made four key alterations to the CTC:[39] All of these provisions were scheduled to expire at the end of 2010 (restrictions imposed by the rules of budget reconciliation, a special parliamentary procedure that allows expedited passage of certain budgetary legislation, often necessitates placing time limits on budget policies, even if legislators hope they will be made permanent).

The Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) increased the size of the CTC to $1,000 for 2003 and 2004 (under EGTRRA, the credit would not have reached $1,000 until 2010).

[41] The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 extended this $1,000 cap through the end of 2012.

[42] The American Taxpayer Relief Act of 2012, signed into law by President Barack Obama, made the $1,000 credit permanent.

The TCJA significantly increased these income thresholds to $200,000 for single parents and $400,000 for married couples filing jointly.

[44] In 2017, Democratic senators Michael Bennet and Sherrod Brown proposed the American Family Act (AFA).

[51][52] The proposal did ultimately influence the expanded child tax credit included in the American Rescue Plan Act of 2021, however (see section below).

In February 2021, shortly after Joe Biden assumed the presidency and Democrats gained a narrow majority in the Senate, Republican Senator Mitt Romney released his "Family Security Act", a proposal to provide families with a yearly benefit of $3,000 per child ages 6–16 and $4,200 per child ages 0–5, with a maximum allowable benefit of $15,000 and the same phaseout structure as the CTC under the TCJA.

[53][54] Like the child tax credit expansion proposed in the American Family Plan and instituted by the ARP, the benefit would be delivered as monthly payments; additionally, it would also allow families to begin claiming the benefit four months before the expected birth date of their child.

[54] Unlike the Democratic proposals, Romney's plan would have the benefit administered by the Social Security Administration (SSA) rather than the Internal Revenue Service (IRS).

[h] The child benefit under Romney's plan would be larger than that of the ARP (except for very large families, who would have their benefit capped under Romney's plan) and would substantially reduce child poverty, though to a lesser extent than the ARP because Romney's plan would be financed in part by substantially reducing the earned income tax credit for taxpayers with children and eliminating Temporary Assistance for Needy Families (TANF) and the Child and Dependent Care Tax Credit (as a result, the proposal would actually increase poverty among many single-parent families[55][56]).

[53] In April 2021, Republican Senator Josh Hawley introduced a related proposal called the "Parent Tax Credit" (PTC).

[e][16] 39 million households covering 88% of children in the United States began receiving payments automatically on July 15, 2021.

[19] The bill stalled in the Senate[65] and was ultimately replaced by the Inflation Reduction Act of 2022, which did not include an expansion to the child tax credit.

[14] Furthermore, according to Columbia University's Center on Poverty and Social Policy, over 50% of black and Hispanic children are in families with incomes too low to receive the full benefit and nearly 1-in-5 black children are in families with incomes too low to receive any of the credit.

[73] Excluding the poorest families from the full benefit substantially reduces the poverty alleviation effects of the CTC: the Jain Family Institute, for instance, estimates that making the child tax credit fully refundable—without any change to benefit levels—would reduce child poverty by 19%.

[87][88][89] To log in to the website, users faced a number of requirements that ordinary taxpayers do not have to satisfy when filing their tax returns, including providing an email address, receiving a log-in code on their phone, scanning a photo ID, and taking a picture of themselves with a computer or smartphone (which is run through facial recognition software)—all administrative burdens that make completing the online form more difficult, particularly for low-income families.