Climate finance

However, the crisis has placed great additional strain on the global economy, debt and the availability of finance, which are expected to be felt in years to come.

[18] The capital required to meet projected energy demand through 2030 amounts to $1.1 trillion per year on average, distributed (almost evenly) between the large emerging economies (China, India, Brazil, etc.)

[20] The IEA estimates that limiting the rise in global temperature to below 2 Celsius by the end of the century will require an average of $3.5 trillion a year in energy sector investments until 2050.

[5]: 2588 The largest proportions of adaptation finance have been invested in infrastructure, energy, built environment, agriculture, forestry/nature and water-related projects.

Data show that per capita needs tend to increase with income level, but these countries can also afford to invest more domestically.

[7]: 42 This equals about 33% of the total public climate finance, with an additional 14% spending on cross-cutting activities (supporting both adaptation and mitigation).

Other options include remittances, increased finance for small businesses, and reform of the international financial system, for example through changes in managing vulnerable countries' debt burden.

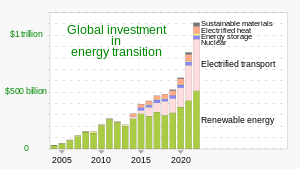

[3]: 1550 [7]: 16 A report published in January 2025 found that low carbon energy investments reached 2.1 trillion dollars, but the rate of growth was more than 2 times lower in 2024 (11%) in comparison to the 3 previous years.

The latter sponsors innovative approaches to existing climate change challenges, whereas the former invests in clean technology projects in developing countries.

Other multilateral climate funds use a wider range of financing instruments, including grants, concessional loans, equity (shares in an entity) and risk mitigation options.

[31] They complement the programmes of (national government) members' bilateral development agencies, allowing them to work in more countries and at a larger scale.

Until quite recently they have been the largest contributors to climate finance, but since 2020 bilateral flows have decreased whilst multilateral funding has grown.

Domestic targets on addressing climate change are set out in national strategies and plans, including those submitted to the UNFCCC under the Paris Agreement.

This means that policy makers need to take a strategic approach through using public funding to leverage additional private finance.

Debt-for-climate swaps happen where debt accumulated by a country is repaid upon fresh discounted terms agreed between the debtor and creditor, where repayment funds in local currency are redirected to domestic projects that boost climate mitigation and adaptation activities.

[47] Climate mitigation activities that can benefit from debt-for-climate swaps includes projects that enhance carbon sequestration, renewable energy and conservation of biodiversity as well as oceans.

[59] Data for 2021/2022 showed it to be almost USD 1.3 trillion, with most of the increase coming from acceleration in mitigation finance (renewable energy and transport sectors).

As of November 2020, development banks and private finance had not reached the US$100 billion per year investment stipulated in the UN climate negotiations for 2020.

[60] Climate financing by the world's six largest multilateral development banks (MDBs) rose to a seven-year high of $35.2 billion in 2017.

[68] In 2019 the EIB Board of Directors approved new targets for climate action and environmental sustainability to phase out fossil fuel financing.

[73] In the same timeframe, the Bank granted around €881 million to assist in the management of wastewater, stormwater, and solid waste to decrease pollution entering the ocean.

[76] The EIB, the European Commission, and Breakthrough Energy, launched by Bill Gates in 2015, have collaborated to build large-scale green tech initiatives in Europe and encourage investment in crucial climate technologies.

[78][79][80] In the three years preceding the pandemic, over two-thirds of EU towns boosted infrastructure investments, with a 56% focus on climate change mitigation.

[84][85] External variables, such as consumer pressure and energy taxes, are more relevant than firm-level features, such as size and age, in influencing the quality of green management practices.

[3]: 1566 International public finance from multilateral and bilateral sources can be tagged to specify that it is targeting climate mitigation or adaptation or both (i.e. is cross-cutting).

[94] This has led to an inclusion of non-climate projects, a lack of transparency and ultimately a credibility issue regarding official international climate finance reporting.

[94] The estimates of the climate finance gap - that is, the shortfall in investment - vary according to the geographies, sectors and activities included, timescale and phasing, target and the underlying assumptions.

[88] Developed countries are responsible for the majority of cumulative greenhouse gas emissions since the industrialization and generally have greater capacity to provide support.

Therefore, it is argued, that they have a moral responsibility and a legal obligation to provide finance to help developing countries undertake climate action.

[10] At the 16th Conference of the Parties in 2010 developed countries committed to the goal of mobilizing jointly USD 100 billion per year by 2020 to address the needs of developing countries, and the decision by the 2015 United Nations Climate Change Conference also included the commitment to continue their existing collective mobilization goal through 2025.