Corporate law

According to Black's Law Dictionary, in America a company means "a corporation — or, less commonly, an association, partnership or union — that carries on industrial enterprise.

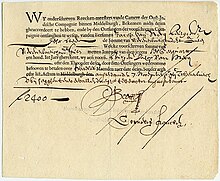

With increasing international trade, Royal charters were granted in Europe (notably in England and Holland) to merchant adventurers.

Companies returned to the forefront of commerce, although in England to circumvent the Bubble Act 1720 investors had reverted to trading the stock of unincorporated associations, until it was repealed in 1825.[relevant?]

Much strong academic, legislative and judicial opinion was opposed to the notion that businessmen could escape accountability for their role in the failing businesses.

Separate legal personality allows corporate groups flexibility in relation to tax planning, and management of overseas liability.

For instance in Adams v. Cape Industries plc[12] it was held that victims of asbestos poisoning at the hands of an American subsidiary could not sue the English parent in tort.

Whilst academic discussion highlights certain specific situations where courts are generally prepared to "pierce the corporate veil", to look directly at, and impose liability directly on the individuals behind the company; the actual practice of piercing the corporate veil is, at English law, non-existent.

While post-war discourse centred on how to achieve effective "corporate democracy" for shareholders or other stakeholders, many scholars have shifted to discussing the law in terms of principal–agent problems.

These are the country's statutes: in the US, usually the Delaware General Corporation Law (DGCL); in the UK, the Companies Act 2006 (CA 2006); in Germany, the Aktiengesetz (AktG) and the Gesetz betreffend die Gesellschaften mit beschränkter Haftung (GmbH-Gesetz, GmbHG).

The United States, and a few other common law countries, split the corporate constitution into two separate documents (the UK got rid of this in 2006).

The articles of association (or by-laws) is the secondary document, and will generally regulate the company's internal affairs and management, such as procedures for board meetings, dividend entitlements etc.

It is quite common for members of a company to supplement the corporate constitution with additional arrangements, such as shareholders' agreements, whereby they agree to exercise their membership rights in a certain way.

Conceptually a shareholders' agreement fulfills many of the same functions as the corporate constitution, but because it is a contract, it will not normally bind new members of the company unless they accede to it somehow.

Another common method of supplementing the corporate constitution is by means of voting trusts, although these are relatively uncommon outside the United States and certain offshore jurisdictions.

UK law specifically reserves shareholders right and duty to approve "substantial non cash asset transactions" (s.190 CA 2006), which means those over 10% of company value, with a minimum of £5,000 and a maximum of £100,000.

[25] Countries with co-determination employ the practice of workers of an enterprise having the right to vote for representatives on the board of directors in a company.

In Aberdeen Ry v. Blaikie (1854) 1 Macq HL 461 Lord Cranworth stated in his judgment that, However, in many jurisdictions the members of the company are permitted to ratify transactions which would otherwise fall foul of this principle.

The standard of skill and care that a director owes is usually described as acquiring and maintaining sufficient knowledge and understanding of the company's business to enable him to properly discharge his duties.

Each is meant to facilitate the contribution of specific resources - investment capital, knowledge, relationships, and so forth - towards a venture which will prove profitable to all contributors.

Except for the partnership, all business forms are designed to provide limited liability to both members of the organization and external investors.

[32] A mix of both debt and equity is crucial to the sustained health of the company, and its overall market value is independent of its capital structure.

If a company wishes to raise capital through equity, it will usually be done by issuing shares (sometimes called "stock" (not to be confused with stock-in-trade)) or warrants.

Shares also normally have a nominal or par value, which is the limit of the shareholder's liability to contribute to the debts of the company on an insolvent liquidation.

[36] Illegal insider trading is believed to raise the cost of capital for securities issuers, thus decreasing overall economic growth.

[37] In the United States and several other jurisdictions, trading conducted by corporate officers, key employees, directors, or significant shareholders (in the United States, defined as beneficial owners of ten percent or more of the firm's equity securities) must be reported to the regulator or publicly disclosed, usually within a few business days of the trade.

[38] Shareholder activism prioritizes wealth maximization and has been criticized as a poor basis for determining corporate governance rules.

Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation.

The United Kingdom was the first country to draft modern corporation statutes,[40] where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors.

The general meeting holds a series of minimum rights to change the company constitution, issue resolutions and remove members of the board.

Through the Takeover Code the UK strongly protects the right of shareholders to be treated equally and freely trade their shares.