Corporation tax in the Republic of Ireland

In 2017, it forced the Central Bank of Ireland to supplement GDP with an alternative measure, modified gross national income (GNI*), which removes some of the distortions by BEPS tools.

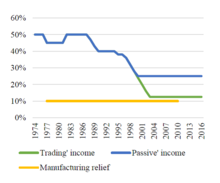

[24][58][59] The transformation was accelerated when Ireland's standard corporate tax rate was reduced from 40% to 12.5% (phased in from 1996 to 2003), in response to the EU's 1996–1998 decision to withdraw the State-aid waiver.

Ireland's IP–based BEPS tools have only attracted material operations from multinationals whose home jurisdiction had a "worldwide tax" system; namely, the U.K pre–2009, and the U.S. pre–2018 (see Table 1).

Ireland has not attracted material technology or life sciences multinationals (outside of a specific plant, under its TP–based Contract Manufacturing BEPS tool), whose home jurisdiction operates a "territorial tax" system.

[98][115][149] Despite the loss of taxes to the U.S. exchequer, it was the EU Commission that forced Ireland to close the Double Irish from January 2015;[116] with closure to existing users by 2020.

[155] A November 2017 report by Christian Aid, titled Impossible Structures, showed how quickly the Single Malt BEPS tool was replacing the Double Irish.

[159] In November 2018, the Irish Government amended the Ireland–Malta tax treaty to prevent the Single Malt BEPS tool being used between Ireland and Malta (it can still be used with the UAE for example).

[11][171] The KDB behaves like a CAIA BEPS scheme with a cap of 50% (i.e. similar to getting 50%–relief against capitalised IP, for a net effective Irish tax rate of 6.25%).

In early 2018, the Central Bank upgraded the L-QIAIF regime so that it could replicate the Section 110 SPV (e.g. closed end debt structures), but without needing to file public CRO accounts.

[203][204] In spite of this, many Irish IP–based BEPS tools are so large that tax academics have been able to separate out their scale from filed group accounts (e.g. work of Gabriel Zucman).

[203][204] However, as most foreign multinationals in Ireland are major U.S. listed companies (see Table 1), tax academics have been able to estimate their Irish ETR from U.S. filings.

[245] In February 2014, as a result of Bloomberg's Special Investigation and Trinity College Professor Dr. Jim Stewart's ETR calculations (see above), the "architect" of Ireland's Double Irish BEPS tool, PricewaterhouseCoopers tax-partner Feargal O'Rourke, went on RTÉ Radio to state that: "there was a hole the size of the Grand Canyon", in the analysis.

[252][253] In December 2017, the Department of Finance published a report they commissioned on the Irish corporate tax code by UCC economist, Seamus Coffey.

[258] Until April 2016, the US tax code would only consider the inverted company as foreign (i.e. outside the U.S. tax-code), where the inversion was part of an acquisition, and the Irish target was at least 20% of the value of the combined group.

Redomiciled PLCs in the Irish Balance of Payments: Conducting little or no real activity in Ireland, these companies hold substantial investments overseas.

"Spin-off inversions" and "self-inversions" happen outside of the U.S. (e.g. the corporate/corporate parent had previously left the U.S.), and thus do not need an acquisition of an Irish—based corporate to execute the move to Ireland, as per U.S. tax code requirements (see above).

[296][297] In December 2017, U.S. technology firm Vantiv, the world's largest payment processing company, confirmed it had abandoned its plan to execute a corporate tax inversion to Ireland.

[299] In March 2018, the Head of Life Sciences in Goldman Sachs, Jami Rubin, stated that: "Now that [U.S.] corporate tax reform has passed, the advantages of being an inverted company are less obvious".

While the Obama administration blocked the proposed $160 billion Pfizer–Allergan tax inversion to Ireland in 2016 (see above), Apple completed a much larger transaction in Q1 2015, that remained unknown until January 2018.

[304] As of November 2018[update], the UK had received the 3rd–largest number of U.S. corporate tax inversions in history, only ranking behind Ireland and Bermuda in popularity (see above).

In September 2008, The New York Times reported that "Britain is facing a potential new problem: an exodus of British companies fleeing the tax system".

[9] In October 1994, the Financial Times chronicled how the EU Commission forced the closure of the Double Irish BEPS tool in 2015 on the threat of a full State-aid investigation into Ireland's tax code.

[312][313] In March 2018, the EU Commission proposed a "Digital Services Tax" (DST), targeted at U.S. technology firms using Irish BEPS tools.

[320] The EU Commission's long-standing desire to introduce a Common Consolidated Corporate Tax Base ("CCCTB"), would have a more severe effect on Ireland's CT system.

'Without its low-tax regime, Ireland will find it hard to sustain economic momentum,' he said.The following are the historical rates of Irish corporation tax since 1994.

During the years of W. T. Cosgrave's governments, the principal aim with regard to fiscal policy was to reduce expenditure and follow that with similar reductions in taxation.

While this measure benefited all income earners, be they private individuals or incorporated companies, a number of adjustments in the Finance Acts, culminating in 1928, increased the allowance on which firms were not subject to taxation under the CPT.

A measure which marked the last years of the Cumann na nGaedheal government, and one that was out of kilter with their general free trade policy, but which came primarily as a result of Fianna Fáil pressure over the 'protection' of Irish industry, was the introduction of a higher rate of CPT for foreign firms.

Indeed, only one policy sticks out during those year of Fianna Fáil rule; being the continued reduction in the level of the allowance on which firms were to be exempt from taxation under the CPT, from £10,000 when Cumman na nGaehael left office, to £5,000 in 1932 and finally to £2,500 in 1941.

One other aspect of the Fianna Fáil government which bears all the fingerprints of Seán Lemass, was the 1946 decision to allow mining companies to write off all capital expenditure against tax over five years.

Brad Setser & Cole Frank ( CoFR ). [ 3 ]

Brad Setser & Cole Frank ( CoFR ). [ 3 ]

Brad Setser & Cole Frank (the Council on Foreign Relations ) [ 148 ]