Corporatocracy

[1] The concept has been used in explanations of bank bailouts, excessive pay for CEOs, and the exploitation of national treasuries, people, and natural resources.

[12] According to economist Joseph Stiglitz, there has been a severe increase in the market power of corporations, largely due to U.S. antitrust laws being weakened by neoliberal reforms, leading to growing income inequality and a generally underperforming economy.

[16] He suggested that it arose from four trends: weak national parties and strong political representation of individual districts, the large U.S. military establishment after World War II, large corporations using money to finance election campaigns, and globalization tilting the balance of power away from workers.

[16] In 2013, economist Edmund Phelps criticized the economic system of the U.S. and other western countries in recent decades as being what he calls "the new corporatism", which he characterizes as a system in which the state is far too involved in the economy and is tasked with "protecting everyone against everyone else", but at the same time, big companies have a great deal of influence on the government, with lobbyists' suggestions being "welcome, especially if they come with bribes".

[17] During the Gilded Age in the United States, corruption was rampant, as business leaders spent significant amounts of money ensuring that government did not regulate their activities.

For example, Senator Elizabeth Warren stated in December 2014 that an omnibus spending bill required to fund the government was modified late in the process to weaken banking regulations.

She repeated President Theodore Roosevelt's warnings regarding powerful corporate entities that threatened the "very foundations of Democracy".

The government lent money to financial institutions at close to zero percent interest and provided generous bailouts on favorable terms when all else failed.

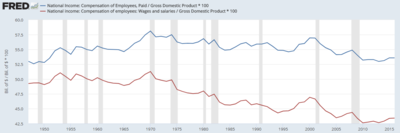

Writing in the Harvard Business Review in September 2014, William Lazonick blamed record corporate stock buybacks for reduced investment in the economy and a corresponding impact on prosperity and income inequality.

It's also their concentration, their capacity to influence, and often infiltrate, governments and their ability to act as a genuine international social class in order to defend their commercial interests against the common good.

[46][47] According to Wacquant, this situation follows the implementation of other neoliberal policies, which have allowed for the retrenchment of the social welfare state and the rise of punitive workfare, whilst increasing gentrification of urban areas, privatization of public functions, the shrinking of collective protections for the working class via economic deregulation and the rise of underpaid, precarious wage labor.

[46][50] According to Wacquant, neoliberalism does not shrink government, but instead sets up a "centaur state" with little governmental oversight for those at the top and strict control of those at the bottom.

[46][51] In his 2014 book, Mark Blyth claims that austerity not only fails to stimulate growth, but effectively passes that debt down to the working classes.

Clara E. Mattei, assistant professor of economics at the New School for Social Research, posits that austerity is less of a means to "fix the economy" and is more of an ideological weapon of class oppression wielded by economic and political elites in order to suppress revolts and unrest by the working class public and close off any alternatives to the capitalist system.

She traces the origins of modern austerity to post-World War I Britain and Italy, when it served as a "powerful counteroffensive" to rising working class agitation and anti-capitalist sentiment.