Monopoly

A monopoly (from Greek μόνος, mónos, 'single, alone' and πωλεῖν, pōleîn, 'to sell') is a market in which one person or company is the only supplier of a particular good or service.

Likewise, a monopoly should be distinguished from a cartel (a form of oligopoly), in which several providers act together to coordinate services, prices or sale of goods.

[citation needed] Monopolies may be naturally occurring due to limited competition because the industry is resource intensive and requires substantial costs to operate (e.g., certain railroad systems).

[citation needed] Perfect price discrimination would allow the monopolist to charge each customer the exact maximum amount they would be willing to pay.

While such perfect price discrimination is a theoretical construct, advances in information technology and micromarketing may bring it closer to the realm of possibility.

[56][57] First degree price discrimination most frequently occurs in regard to professional services or in transactions involving direct buyer-seller negotiations.

For example, an accountant who has prepared a consumer's tax return has information that can be used to charge customers based on an estimate of their ability to pay.

The one is upon every occasion the highest which can be squeezed out of the buyers, or which it is supposed they will consent to give; the other is the lowest which the sellers can commonly afford to take, and at the same time continue their business.

Sometimes this very loss of psychological efficiency can increase a potential competitor's value enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives.

[69][full citation needed] A natural monopoly is an organization that experiences increasing returns to scale over the relevant range of output and relatively high fixed costs.

[72] Natural monopolies are synonymous with what is called "single-unit enterprise", a term which was used in the 1914 book Social Economics written by Friedrich von Wieser.

In his Social Economics,[75] Friedrich von Wieser demonstrated his view of the postal service as a natural monopoly: "In the face of [such] single-unit administration, the principle of competition becomes utterly abortive.

The parallel network of another postal organization, beside the one already functioning, would be economically absurd; enormous amounts of money for plant and management would have to be expended for no purpose whatever.

In 1984, decades after having been granted monopoly power by force of law, AT&T was broken up into various components, MCI, Sprint, who were able to compete effectively in the long-distance phone market.

These breakups are due to the presence of deadweight loss and inefficiency in a monopolistic market, causing the Government to intervene on behalf of consumers and society in order to incite competition.

[88] Also, in cases where an undertaking has previously been found dominant, it is still necessary to redefine the market and make a whole new analysis of the conditions of competition based on the available evidence at the appropriate time.

It arises when a monopolist has such significant market power that it can restrict its output while increasing the price above the competitive level without losing customers.

It arises when a dominant undertaking carrying out excess pricing which would not only have an exploitative effect but also prevent parallel imports and limits intra-brand competition.

Until recently, a combination of strong sunshine and low humidity or an extension of peat marshes was necessary for producing salt from the sea, the most plentiful source.

The much-hated levy had a role in the beginning of the French Revolution, when strict legal controls specified who was allowed to sell and distribute salt.

[95] Robin Gollan argues in The Coalminers of New South Wales that anti-competitive practices developed in the coal industry of Australia's Newcastle as a result of the business cycle.

The monopoly was generated by formal meetings of the local management of coal companies agreeing to fix a minimum price for sale at dock.

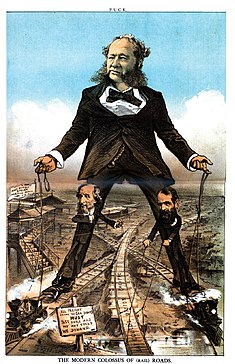

"Trust-busting" critics accused Standard Oil of using aggressive pricing to destroy competitors and form a monopoly that threatened consumers.

Its controversial history as one of the world's first and largest multinational corporations ended in 1911, when the United States Supreme Court ruled that Standard was an illegal monopoly.

In the United States, public utilities are often natural monopolies because the infrastructure required to produce and deliver a product such as electricity or water is very expensive to build and maintain.

[105] The Long Island Power Authority (LIPA) provided electric service to over 1.1 million customers in Nassau and Suffolk counties of New York, and the Rockaway Peninsula in Queens.

The Company traded in basic commodities, which included cotton, silk, indigo dye, salt, saltpetre, tea and opium.

[111] After mergers in 1949 with the AAFC and 1970 with the AFL, the National Football League was facing competition USFL following their successful first season in 1983.

At the same time an antitrust lawsuit was filed against the NFL as it convinced the 3 major American television channels against broadcasting any USFL games.

The US Supreme Court would, four years later, allow the original ruling to stand and order the NFL to pay damages and to include interest, bringing the total to $3.76.