Debt crisis

[citation needed] The causes of the crisis included high-risk lending and borrowing practices, burst real estate bubbles, and hefty deficit spending.

The PIIGS announced strong fiscal reforms and austerity measures, but toward the end of the year, the euro once again suffered from stress.

[12] The eurozone crisis resulted from the structural problem of the eurozone and a combination of complex factors, including the globalisation of finance, easy credit conditions during the 2002–2008 period that encouraged high-risk lending and borrowing practices, the financial crisis of 2007–08, international trade imbalances, real estate bubbles that have since burst; the Great Recession of 2008–2012, fiscal policy choices related to government revenues and expenses, and approaches used by states to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses.

In 1992, members of the European Union signed the Maastricht Treaty, under which they pledged to limit their deficit spending and debt levels.

However, in the early 2000s, some EU member states were failing to stay within the confines of the Maastricht criteria and turned to securitising future government revenues to reduce their debts and/or deficits, sidestepping best practice and ignoring international standards.

[13] This allowed the sovereigns to mask their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions, and the use of complex currency and credit derivatives structures.

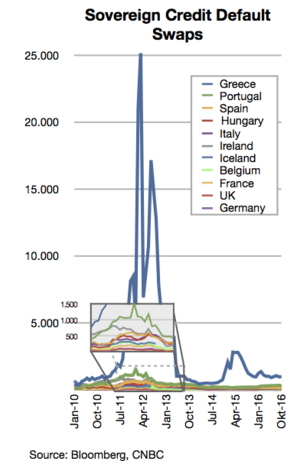

The crisis subsequently spread to Ireland and Portugal, while raising concerns about Italy, Spain, and the European banking system, and more fundamental imbalances within the eurozone.

[16] After publication of GDP data which showed an intermittent period of recession starting in 2007,[17] credit rating agencies then downgraded Greek bonds to junk status in late April 2010.

In November 2011, Greece faced with a storm of criticism over his referendum plan, Mr Papandreou withdraws it and then announces his resignation.

In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

On 13 July, after 17 hours of negotiations, Eurozone leaders reached a provisional agreement on a third bailout programme, substantially the same as their June proposal.

[23] In June 2017, news reports indicated that the "crushing debt burden" had not been alleviated and that Greece was at the risk of defaulting on some payments.

[26] To take considerations that the most characteristic feature of the Greek social landscape in the current crisis is the steep rise in joblessness.

It then began to fall until May 2008, when unemployment figures reached their lowest level for over a decade (325,000 workers or 6.6 per cent of the labour force).

Average real gross earnings for employees have lost more ground since the onset of the crisis than they gained in the nine years before that.

[27] In February 2012, it was reported that 20,000 Greeks had been made homeless during the preceding year, and that 20 per cent of shops in the historic city centre of Athens were empty.

After some fumbling, he adopted a free-market approach that reduced the burden of government by privatizing, deregulating, cutting some tax rates, and reforming the state.

[38] People who criticize Vargas have said that he made a $1 billion "backroom deal" with swaps of Argentine bonds as a sign of his friendship with Chavez.

This led to a “lost decade” of low economic growth, increased poverty, food insecurity and socio-political instability.