Hyperinflation in Venezuela

In comparison to previous hyperinflationary episodes, the ongoing hyperinflation crisis is more severe than those of Argentina, Bolivia, Brazil, Nicaragua, and Peru in the 1980s and 1990s, and that of Zimbabwe in the late-2000s.

[23] The same year, following a cut in government spending and the opening of markets by President Carlos Andrés Pérez, the capital city of Caracas suffered from looting and rioting.

[27] Following the 1998 Venezuelan presidential election, the inflation rate, measured by consumer price index, was 35.8% in 1998, falling to a low of 12.5% in 2001 but rising to 31.1% in 2003.

In an attempt to support the Venezuelan bolívar, bolster the government's declining level of international reserves, and mitigate the impact of the oil industry work stoppage on the economy, the Ministry of Finance and the Central Bank of Venezuela (BCV) suspended foreign exchange trading on 23 January 2003.

[10] The same year, a trend began in Venezuela in which gold farming in cybergames, such as RuneScape, became an acquirable[clarification needed] way to obtain hard currency.

One of the sources claimed that this disclosure might bring Venezuela into compliance with the IMF, making it harder to support Juan Guaidó during the presidential crisis.

[47] In October 2018, the IMF estimated that the inflation rate would reach 10,000,000% by the end of 2019, which was again mentioned in its April 2019 World Economic Outlook report.

This has objective and subjective components: According to experts, Venezuela's economy began to experience hyperinflation during the first year of Nicolás Maduro's presidency.

[55] In early 2014, the BCV did not release statistics for the first time in its history, with Forbes reporting that it was a possible way to manipulate the image of economy.

[56] In April 2014, the IMF stated that economic activity in Venezuela was uncertain but may continue to slow, and that "loose macroeconomic policies have generated high inflation and a drain on official foreign exchange reserves".

[62] Maduro has blamed capitalist speculation for driving high inflation rates and creating widespread shortages of basic necessities.

[63] Maduro has been criticized for concentrating on public opinion instead of tending to practical issues that have been warned by economists, or creating solutions to improve Venezuela's economic prospects.

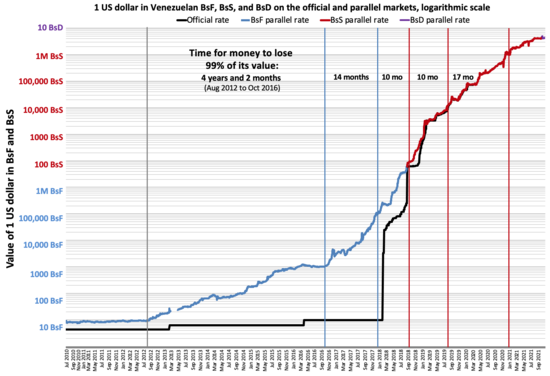

This made the bolívar fuerte the second least-valued circulating currency in the world based on the official exchange rate, behind only the Iranian rial.

[81] According to El Nuevo Herald, most economists said that the measure would only help temporarily due to the official inflation rate being over 59%, and that the wage increase would only make things more difficult for companies, since they already faced a shortage of currency.

[92] In March 2019, The Wall Street Journal stated that the "main cause of hyperinflation is the central bank printing money to fund gaping public spending deficits", reporting that a teacher could only buy a dozen eggs and two pounds of cheese with a month's wages.

[96] In 2014, El Nuevo Herald reported that due a lack of money, SEBIN had decreased its work of monitoring of "potential external threats" and asked for Cuban intelligence agents to return to Venezuela.

[18] Bloomberg's Café Con Leche Index calculated the price of a cup of coffee to have increased 718% in the 12 weeks before 18 January 2018, an annualized inflation rate of 448,000%.

[150] By the end of the year, it was estimated that it would increase to 39% to 40%, and that 60% of the economically active population belong to the informal sector, which influences the low salary that has caused many young people to emigrate to other countries.

[152] According to the UNHCR, the deterioration of the political, economic and human rights situation in Venezuela continues, making international support necessary.

[155][156]< It was also stated in the BCV's August report that it was an "economic war that hindered the normal course of production activities and distribution of essential goods demanded by the Venezuelan people".

On 11 December 2016, President Maduro, who had been ruling by decree, wrote into law that 100 Bs.F notes would be pulled from circulation within 72 hours due to "mafias" allegedly storing them to drive inflation.

[169] The government of India has done a similar action in November 2016, by withdrawing the 500 and 1000 rupee notes from circulation that would curtail the shadow economy and reduce the use of illicit and counterfeit cash to fund illegal activity and terrorism.

[170][171] On 14 February 2017, Paraguayan authorities uncovered a 30-tonne (66,000 lb) stash of 50 and 100 Bs.F banknotes totaling 1.5 billion Bs.F on its Brazilian border that had not yet been circulated.

[172] In December 2017, President Maduro announced that Venezuela would introduce a state cryptocurrency called the 'Petro' in an attempt to shore up its struggling economy.

[173][174] Maduro stated that the Petro would allow Venezuela to "advance in issues of monetary sovereignty",[175] and that it would make "new forms of international financing" available to the country.

[173] Opposition leaders, however, expressed doubt due to Venezuela's economic turmoil,[174] pointing to the falling value of the Venezuelan bolívar, its fiat currency, and $140 billion in foreign debt.

[177] On the same month, Maduro announced that Venezuela would issue 100 million tokens of the petro,[178] which would put the value of the entire issuance at just over $6 billion.

It also established a cryptocurrency government advisory group called VIBE to act as "an institutional, political and legal base" from which to launch the petro.

The rounding created difficulties because some items and sales quantities were priced significantly less than 0.50 Bs.S; for example, 1 litre (0.26 US gal) of gasoline and a Caracas Metro ticket typically cost 0.06 Bs.S and 0.04 Bs.S, respectively.

However, the exchange rate appreciated to about 20,000 Bs.S per USD by 10 October 2019[96] Following increased international sanctions throughout 2019, the Maduro government abandoned policies established by Chávez such as price and currency controls (imposed since 2003) which resulted in the country seeing a rebound from economic decline.