Double Irish arrangement

Despite US knowledge of the Double Irish for a decade, it was the European Commission that in October 2014 forced Ireland to close the scheme, starting in January 2015.

However, by mid-2018, other tax academics, including the IMF, noted that technical flaws in the TCJA had increased the attractiveness of Ireland's BEPS tools, and the CAIA BEPS tool in particular, which post-TCJA, delivered a total effective tax rate (ETR) of 0–2.5% on profits that can be fully repatriated to the US without incurring any additional US taxation.

[7] Under OECD rules, corporations with intellectual property (IP), which are mostly technology and life sciences firms, can turn this into an intangible asset (IA) on their balance sheet, and charge it out as a tax-deductible royalty payment to end-customers.

[8][9] The Double Irish enables the IP to be charged-out from Ireland, which has a large global network of full bilateral tax treaties.

In October 2007, he met at Google's Dublin headquarters on Barrow Street with Tadhg O'Connell, the head of the Revenue division that audits tech companies.

O'Connell is understood to have rejected O'Rourke's request that royalties like Google's should be able to flow directly to units in Bermuda and Cayman without being taxed.

Two years later, after continued entreaties by O'Rourke, the Revenue's office announced that it would no longer impose withholding taxes on such transactions.The 2014–16 EU investigation into Apple in Ireland (see below), showed that the Double Irish existed as far back as 1991.

[29][38] This approach by successive U.S. administrations is explained by an early insight that one of the most cited U.S. academic researchers into tax havens, and corporate taxation, James R. Hines Jr., had in 1994.

[48] On 3 January 2019, The Guardian reported that Google avoided corporate taxes on US$23 billion of profits in 2017 by using the Double Irish with the Dutch sandwich extension.

[49] By 2017, Apple was Ireland's largest company, and post leprechaun economics, accounted for over one quarter of Irish GDP growth.

[50][51] Apple's use of the Double Irish BEPS tool to achieve tax rates <1%, dates back to the late 1980s,[19] and was investigated by the U.S. Senate in May 2013,[52][53] and covered in the main financial media.

[62] A November 2017 report by Christian Aid, titled Impossible Structures, showed how quickly the Single Malt BEPS tool was replacing the Double Irish.

[68] Figures released in April 2017 show that since 2015 there has been a dramatic increase in companies using Ireland as a low-tax or no-tax jurisdiction for intellectual property (IP) and the income accruing to it, via a nearly 1000% increase in the uptake of a tax break expanded between 2014 and 2017.In September 2018, The Irish Times revealed that U.S. medical device manufacturer Teleflex, had created a new Single Malt scheme in July 2018, and had reduced their overall effective corporate tax rate to circa 3%.

[62] The same article quoted a spokesman from the Department of Finance (Ireland) saying they had not as yet taken any action regarding the Single Malt BEPS tool, but they were keeping the matter, "under consideration".

[72] In September 2021, The Irish Times reported that US pharmaceutical firm Abbott Laboratories was still using the Single Malt tool to shield profits on its COVID-19 testing kits.

[73][74] The Double Irish and Single Malt BEPS tools enable Ireland to act as a confidential "Conduit OFC" rerouting untaxed profits to places like Bermuda (e.g. it must be confidential as higher-tax locations would not sign full tax treaties with locations like Bermuda), the Capital Allowances for Intangible Assets (CAIA) BEPS tool (also called the Green Jersey), enables Ireland to act as the terminus for the untaxed profits (e.g. Ireland becomes Bermuda, a "Sink OFC").

The CAIA capitalises the effect of the Double Irish or Single Malt BEPS tools, and behaves like a corporate tax inversion of a U.S. multinational's non–U.S.

However, the CAIA is more powerful, as Apple demonstrated by effectively doubling the tax shield (e.g. to US$600 billion in allowances), via Irish interest relief on the intergroup virtual loans used to purchase the IP.

[59] In September 2009, the commission recommended that the Irish State provide capital allowances for the acquisition of intangible assets, creating the CAIA BEPS tool.

[h][91] The 2012 Finance Act removed the minimum amortisation period for the acquired intangible assets, and reduced the "clawback" to 5 years for CAIA schemes set up after February 2013.

[95][96] The CAIA follows the first three steps of the Double Irish, and Single Malt, basic structure (see above, except in this case the example is not a per-unit example, but for the entire sales of a block of intellectual property), namely:[78][97][79][98] The CAIA and Double Irish (and Single Malt) share the same basic components and techniques (e.g. an intangible asset needs to be created and significantly re-valued in a tax haven).

[105][106][107] During Q1 2018, Coffey and international economists,[106][107] proved Ireland's 2015 "leprechaun economics" GDP growth of 33.4%, was attributable to Apple's new CAIA BEPS tool.

[99] In June 2018, Apple's post Q1 2015 BEPS tax structure in Ireland was labelled "the Green Jersey" by the EU Parliament's GUE–NGL body and described in detail.

[99] Given the dramatic take-up in the CAIA tool in 2015, when the cap lifted (e.g. the ETR was 0%), Irish commentators challenged Coffey's recommendation.

In July 2018, Coffey posted that Ireland could see a "boom" in the onshoring of U.S. IP, via the CAIA BEPS tool, between now and 2020, when the Double Irish is fully closed.

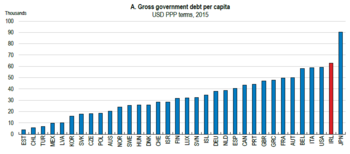

[121] Irish public indebtedness changes dramatically depending on whether Debt-to-GDP, Debt-to-GNI* or Debt-per-Capita is used (Per-Capita removes all BEPS tool distortion).

[157] Leading U.S. tax academic, Mihir A. Desai[t] in a post–TCJA 26 December 2017 interview in the Harvard Business Review said that: "So, if you think about a lot of technology companies that are housed in Ireland and have massive operations there, they're not going to maybe need those in the same way, and those can be relocated back to the U.S.[158] In December 2017, U.S technology firm Vantiv, the world's largest payment processing company, confirmed that it had abandoned its plan to execute a corporate tax inversion to Ireland.

[159] In March 2018, the Head of Life Sciences in Goldman Sachs, Jami Rubin, stated that: "Now that [U.S.] corporate tax reform has passed, the advantages of being an inverted company are less obvious".

[114] In February 2019, Brad Setser from the Council on Foreign Relations wrote a New York Times article highlighting material issues with TCJA in terms of combatting tax havens.

[169] This is not a comprehensive list as many US multinationals in Ireland use "unlimited liability companies" (ULCs), which do not file public accounts with the Irish CRO.

From the corporation:

- CORP (X) creates the software.

- CORP (X) sells IP to BER1 (H).

- BER1 (H) revalues IP higher.

- BER1 (H) licenses IP to IRL2 (A).

- IRL2 (A) licenses IP to DUT1 (S).

- DUT1 (S) licenses IP to IRL1 (B).

- IRL1 (B) sells software to customer.

From the customer :

- Customer pays $100 to IRL1 (B).

- IRL1 (B) pays $100 to DUT1 (S) as royalty.

- DUT1 (S) pays $100 to IRL2 (A) as royalty.

- IRL2 (A) pays $100 to BER1 (H) as royalty.

- BER1 (H) accumulates the cash.

- BER1 (H) can lend cash to CORP (X).