Duty drawback

Duty drawback is the oldest trade program in the United States and was codified in 1789.

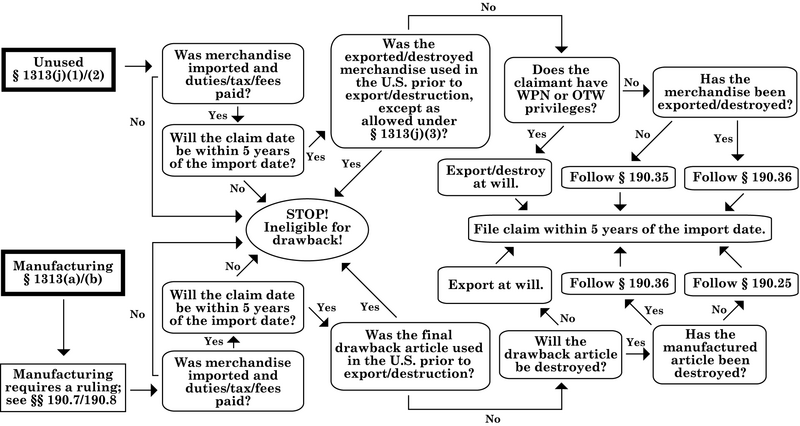

Drawback is the refund of duties, certain taxes, and certain fees collected upon the importation of merchandise into the United States.

Claimants can recover the following duties, taxes and fees paid on the imported merchandise: Claims are filed in accordance with the requirements in 19 C.F.R.

Part 190 and the generalized instructions in the ACE Business Rules and Process Document found on CBP.gov.

All claims must be filed electronically with CBP through the Automated Broker Interface (ABI).

Claimants are required to electronically transmit the claim data defined in the drawback CATAIR, which can be found on CBP.gov.

Claimants may file a claim in one of three ways: Service providers, and software vendors can be found on CBP.gov.

CEE drawback offices are located at Newark/New York, Houston, Chicago, Detroit, and San Francisco.

CBP has pre-approved several common manufacturing processes as “general” rulings (found in Appendix A of 19 C.F.R.

Once the requirements of the NOI have been met, the merchandise may be exported, and the executed Form 7553 is included with the drawback claim.

For merchandise that will be destroyed, an NOI must be submitted to CBP prior to destruction per the requirements in 19 C.F.R.

CBP has personnel dedicated to assisting filers successfully transmit their claims: claimants may contact an ABI rep by sending an email to clientrepoutreach@cbp.dhs.gov.

Drawback on merchandise exported to Canada or Mexico subject to NAFTA can be claimed per the guidance in 19 C.F.R.

Drawback on merchandise exported to Canada or Mexico subject to USMCA can be claimed per the guidance in 19 C.F.R.

Part 191) Drawback filing instructions at CBP.gov Customs Rulings Online [2]; include the term 'drawback' in the search field.