Economic effects of the September 11 attacks

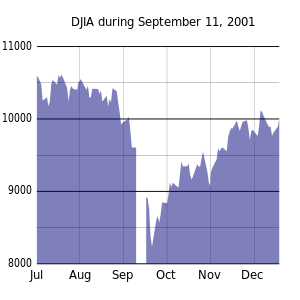

The September 11 attacks in 2001 were followed by initial shocks causing global stock markets to drop sharply.

The New York Stock Exchange Building was then evacuated as well as nearly all banks and financial institutions on Wall Street and in many cities across the country.

[5] Federal Reserve Governor Roger W. Ferguson Jr. has described in detail this and the other actions that the Fed undertook to maintain a stable economy and offset potential disruptions arising in the financial system.

[5] Currency trading continued, with the United States dollar falling sharply against the Euro, British pound, and Japanese yen.

A large number of transatlantic flights landed in Gander, Newfoundland and in Halifax, Nova Scotia, with the logistics handled by Transport Canada in Operation Yellow Ribbon.

Swissair, unable to make payments to creditors on its large debt was grounded on 2 October 2001 and later liquidated.

[1] The reduction in air travel demand caused by the attack is seen as a contributory reason for the retirement of the only supersonic aircraft in service at the time, Concorde.

[14] Tourism in New York City plummeted, causing massive losses in a sector that employed 280,000 people and generated $25 billion per year.

Suzanne Thompson, Professor of Psychology at Pomona College, conducted interviews of 501 people who were not direct victims of 9/11.

[18] The 9/11 attacks had great impact on small businesses in Lower Manhattan, located near the World Trade Center.

[18] The September 11 attacks led directly to the U.S. war in Afghanistan, as well as additional homeland security spending.