Economic policy of the Barack Obama administration

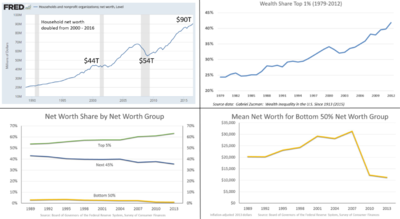

As the economy improved and job creation continued during his second term (2013–2017), the Bush tax cuts were allowed to expire for the highest income taxpayers and a spending sequester (cap) was implemented, to further reduce the deficit back to typical historical levels.

[15] President Obama also attempted to address inequality before taxes (i.e., market income), with infrastructure investment to create middle-class jobs and a federally-mandated increase in the minimum wage.

[26] The Bush Administration had passed the $700 billion Troubled Asset Relief Program in October 2008 and provided enormous loan guarantees to help strengthen the banks as late as January 2009 during the transition period.

Further, the U.S. Federal Reserve under Ben Bernanke was taking a series of innovative emergency steps to inject money into the financial system, acting in their role as the "lender of last resort".

[1][27] On February 17, 2009, Obama signed into law the American Recovery and Reinvestment Act of 2009, a $787 billion economic stimulus package aimed at helping the economy recover from the deepening worldwide recession.

[37] The economy of the United States has grown faster than the other original NATO members by a wider margin under President Obama than it has anytime since the end of World War II.

As the economy recovered towards full employment, a reduced labor force participation rate among prime working-aged persons (between ages 25 to 54 years old) accounted for a greater share of the shortfall.

[1] On December 10, 2014, the President himself, together with JP Morgan's Jamie Dimon, helped whip House votes in favor of the "cromnibus" spending bill, which included a provision that progressive lawmakers argued would significantly weaken the Dodd-Frank regulations.

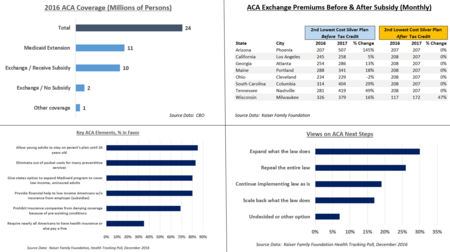

It was built on three related concepts, including: 1) Subsidies for low-income persons to help them purchase health insurance; 2) Guaranteed issue and community rating, meaning persons with pre-existing medical conditions could not be discriminated against; and 3) Coverage requirements, enforced via both individual and employer "mandates" with financial incentives supporting them, to ensure healthy people (with few medical bills) would participate to help keep insurance costs down for all.

[72] Healthcare historian Paul Starr said in December 2017, "If you trace the origins of the ideas in the ACA, it was basically a bi-partisan bill passed on strictly partisan lines.

"[77] However, despite federal financial incentives to do so, many states with Republican governors chose not to expand Medicaid to their residents under the ACA, which adversely affected coverage for lower-income citizens while reducing costs.

[10] The 2017 Economic Report of the President also stated that ACA has improved healthcare quality, saying Since 2010, the rate at which patients are harmed while seeking hospital care has fallen by 21 percent, which is estimated to have led to approximately 125,000 avoided deaths through 2015.

For example, automatic stabilizer spending (such as unemployment compensation, food stamps, and disability payments, which increased without legislative action) ranged between $350–420 billion annually from 2009 to 2012,[88] roughly 10% of the expenditures.

This resulted in a series of bruising debates with the Republican Congress, which attempted (with much success) to blame the President for the deficits caused primarily by the recession that began during the Bush administration.

[92] The compromise overcame opposition from some in both parties, and the resulting $858 billion Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 passed with bipartisan majorities in both houses of Congress before Obama signed it on December 17, 2010.

[96] President Obama referred to the situation as a "manufactured crisis", while Senate Minority Leader Mitch McConnell called it "a new template...[raising] the debt ceiling will not be clean anymore.

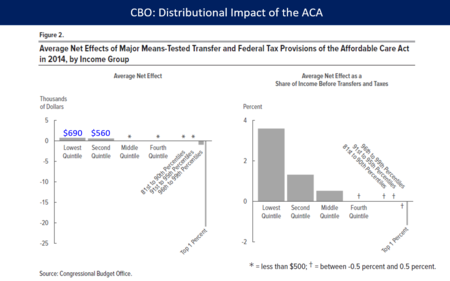

Separately enacted as part of Obamacare, individual mandates and tobacco taxes impacted the middle class slightly, although they were mainly designed to adjust behavior rather than gather revenue.

[87] The CBO had forecast that cutting the deficit towards the current law baseline would have a significant risk of recession in 2013 along with higher unemployment, so a more moderate trajectory was chosen by the President and Congress.

Both Martin Wolf[165] and Paul Krugman[166] explained that as the Great Recession hit, the saving (deleveraging) of the private sector significantly increased, while business investment declined in the face of reduced consumer spending.

Supporting the recovery process were the stimulative monetary policies of the Federal Reserve, which maintained low interest rates and asset buying programs to encourage economic growth throughout President Obama's tenure.

In 2008, The New York Times, which had endorsed Hillary Clinton,[183] charged that, in revising his bill, Obama had "removed language mandating prompt reporting and simply offered guidance to regulators".

"[185] Obama and other senators introduced a bill in 2007 to promote the development of commercially viable plug-in hybrids and other electric-drive vehicles in order to shift away from petroleum fuels and "toward much cleaner – and cheaper – electricity for transportation".

Obama supported the Employee Free Choice Act, a bill that adds penalties for labor violations and which would circumvent the secret ballot requirement to organize a union.

[208] In January 2014 he signed an executive order raising the minimum wage for federal "workers who are performing services or constructing buildings" to $10.10/hr and began garnering support for a bill to enact this change nationally.

"[230] Obama reaffirmed his commitment to net neutrality at a meeting with Google employees in November 2007, at which he said, "once providers start to privilege some applications or web sites over others, then the smaller voices get squeezed out, and we all lose.

[239] During an October 13, 2008 speech at Toledo, Ohio, Obama said that for the next two years, he favors a $3,000 tax credit to businesses for each new full-time employee whom they hire above the number in their current work force.

"[242] Thomas L. Hungerford of the Congressional Research Service has written that "allowing the tax cuts targeted to high income taxpayers to expire as scheduled could help reduce budget deficits in the short-term without stifling the economic recovery.

That's why he opposes these ballot initiatives, which would roll back opportunity for millions of Americans and cripple efforts to break down historic barriers to the progress of qualified women and minorities.

"[268] In July, Obama stated, "I am a strong supporter of affirmative action when properly structured so that it is not just a quota, but it is acknowledging and taking into account some of the hardships and difficulties that communities of color may have experienced, continue to experience, and it also speaks to the value of diversity in all walks of American life.

[272] Obama also noted that free trade comes with its own costs: he believes the displacement of Mexican farmers by more efficient American counterparts has led to increased immigration to the United States from that country.