Economic policy of the first Donald Trump administration

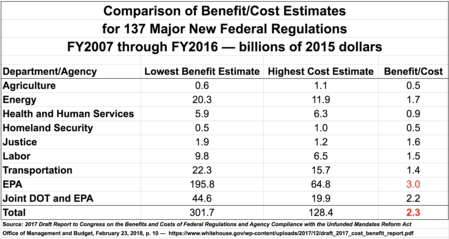

The economic policy of the first Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.

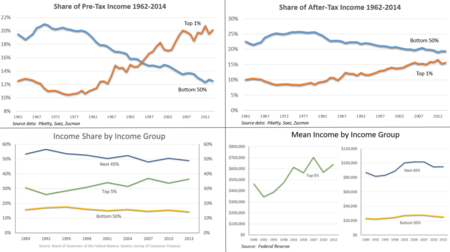

[1] During Trump's first three years in office, the number of Americans without health insurance increased by 4.6 million (16%),[8][9] while his tax cuts favored the top earners, and failed to deliver on its promises,[10] worsened income inequality, and eroded the country’s revenue needed to continue investment to critical programs like social security and medicine.

[22] Economist Paul Krugman expressed a similar view in February 2020, writing that Trump's initial promises of a more bi-partisan agenda (e.g., raising taxes on the rich, infrastructure investment and preserving safety net programs) ultimately gave way to pursuing more typical Republican policy priorities of tax cuts and reduced safety net spending, although without the previous concerns about the budget deficit that Republicans expressed during the Obama Administration.

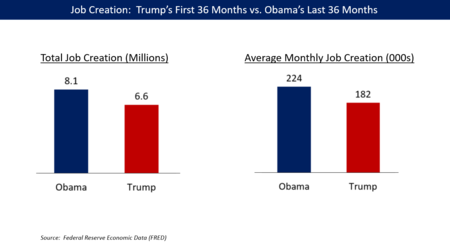

[34] Writing in The Washington Post, Heather Long explained in August 2019 that: "[A] closer look at the data shows a mixed picture in terms of whether the economy is any better than it was in Obama's final years.

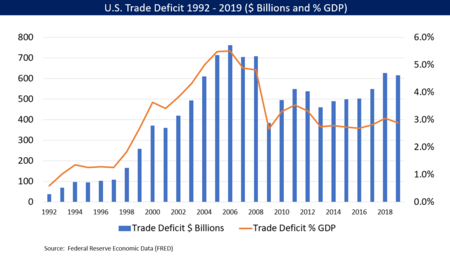

Nominal wages, consumer and business confidence, and manufacturing job creation (initially) compared favorably, while government debt, trade deficits, and persons without health insurance did not.

[74][75] The Washington Post cited research indicating that mortality increases about one person per 800 without health insurance, so 2 million more uninsured represents 2,500 avoidable deaths per year.

[94] CBO released an analysis in May 2019 that stated: "By 2021, in the current baseline, 7 million more people are uninsured than would have been if the individual mandate penalty had not been repealed; subsequently, that number remains roughly constant to the end of the projection period in 2029.

"[95] The New York Times explained that the Affordable Care Act (ACA) was passed in 2010 and extended protections to those with pre-existing health conditions, requiring insurers to "offer coverage to anyone who wishes to buy it, with prices varying only by region and age of the customer."

[99] The Centers for Medicare and Medicaid Services website states that 50–129 million non-elderly Americans (19–50 percent) have pre-existing conditions that could place them at risk of losing insurance coverage without ACA protections.

However, Politifact rated this claim as "Mostly False", explaining that: "In 2019, 4,311 prescription drugs experienced a price hike, with the average increase hovering around 21%, according to data compiled by Rx Savings Solutions, a consulting group.

"[103] The Kaiser Family Foundation surveyed the employer-sponsored health insurance market, reporting in September 2019 that:[55] President Trump and Republicans in Congress tried repeatedly to repeal or replace the ACA, without success.

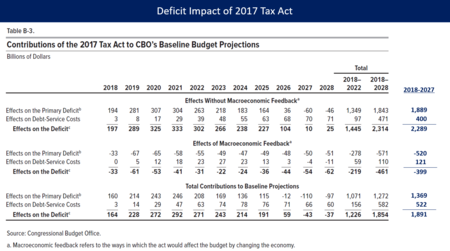

Kevin Hassett, chairman of Trump's Council of Economic Advisers, noted days earlier that the deficit was "skyrocketing," which is consistent with the analysis of every reputable budget analyst.

"[150] President Trump falsely claimed in August 2018 that "because of tariffs we will be able to start paying down large amounts of the $21 trillion in debt that has been accumulated...while at the same time reducing taxes for our people."

[164] With the notable exception of deficits, actual results for 2017–2019 for these key variables compare favorably against the baseline, as the Tax Cuts and Jobs Act provided a stimulus and the economy was further from full employment than CBO anticipated: A budget document is a statement of goals and priorities, but requires separate legislation to achieve them.

[204] To help address lost income for millions of workers and assist businesses, Congress and President Trump enacted the Coronavirus Aid, Relief, and Economic Security Act (CARES) on March 27, 2020.

While the Act carried an estimated $2.3 trillion price tag, some or all of the loans may ultimately be paid back including interest, while the spending measures should dampen the negative budgetary impact of the economic disruption.

[233] During his February 2019 State of the Union Address, Trump asserted, "Wages are rising at the fastest pace in decades, and growing for blue collar workers, who I promised to fight for, faster than anyone else.

[268] Through October 2020, coal-fueled electricity generating capacity declined faster during Trump's presidency than during any previous presidential term, falling 15% with the idling of 145 coal-burning units at 75 power plants.

[277] The Trans-Pacific Partnership (TPP) was a proposed trade agreement between 12 Pacific Rim countries: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam, and the United States.

The agreement aimed to lower both non-tariff and tariff barriers to trade, establish an investor-state dispute settlement mechanism, and promote economic growth, job creation, innovation, and higher living standards.

Politifact rated this assertion "Pants On Fire,"[281] while the conservative Wall Street Journal editorial board wrote, "It wasn't obvious that [Trump] has any idea what's in [TPP]".

[310] Further, the strategy of protectionism (i.e., to impose trade barriers such as tariffs, to retain or bring jobs back that were off-shored) as opposed to retraining and relocating workers adversely impacted by globalization, is debatable.

[42] The uncertainty for businesses created by the trade war with China following the imposition of tariffs in 2018 likely contributed to a significant decline in manufacturing activity and job creation in 2019, the opposite effect Trump intended.

"[315] Economist Paul Krugman argued in October 2019 that manufacturing had entered a "mini-recession", with production down and employment in Wisconsin, Michigan and Pennsylvania falling significantly from summer 2018 to December 2019, due in part to Trump's trade policies and other behavior that adversely impacted business investment.

[316][317] Analysis published by The Wall Street Journal in October 2020 found the trade war Trump initiated in early 2018 did not achieve the primary objective of reviving American manufacturing, nor did it result in the reshoring of factory production.

[324] Economist Austan Goolsbee explained in October 2019 that GDP growth is a function of the number of people and income per person (productivity), and restricting immigration hurts both measures.

[356] The U.S. Federal Reserve then reversed course in 2019 and both cut rates and resumed expanding its balance sheet, boosting the stock market despite uncertainty created by Trump's trade policies.

In nominal terms (not adjusted for inflation) it declined in 2008 due to the Great Recession but resumed steadily rising in 2009 and reached its sixth consecutive annual record high in 2017.

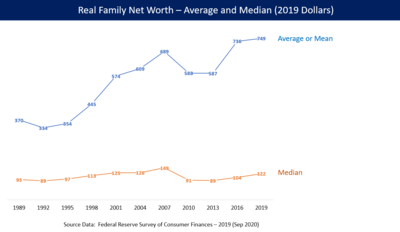

[370] The White House Council of Economic Advisers estimated in October 2017 that the corporate tax cut of the TCJA would increase real median household income by $3,000 to $7,000 annually.

[382] Trump's withdrawal from the Iran nuclear deal in 2018, as well as OPEC quotas established while the global economy was growing (pre-recession), put upward pressure on gasoline prices.