Economic policy of the George W. Bush administration

The economic policy and legacy of the George W. Bush administration was characterized by significant income tax cuts in 2001 and 2003, the implementation of Medicare Part D in 2003, increased military spending for two wars, a housing bubble that contributed to the subprime mortgage crisis of 2007–2008, and the Great Recession that followed.

Further, some influential conservatives such as Alan Greenspan believed that the nearly $5 trillion in budget surpluses forecast by the CBO for the 2002-2011 period should be given back to taxpayers rather than used to pay down the national debt.

[citation needed] The U.S. national debt grew significantly from 2001 to 2009, both in dollar terms and relative to the size of the economy (GDP), due to a combination of tax cuts, wars and recessions.

Since the cuts got implemented as part of the annual congressional budget resolution, which protected the bill from filibusters, numerous amendments, and more than 20 hours of debate, it had to include a sunset clause.

Ultimately, five Senate Democrats crossed party lines to join Republicans in approving a $1.35 trillion[11] tax cut program — one of the largest in U.S. history.

The United States Congress passed the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) on May 23, 2003 and President George W. Bush signed it into law five days later.

[16] In 2003, 450 economists, including ten Nobel Prize laureate, signed the Economists' statement opposing the Bush tax cuts, sent to President Bush stating that "these tax cuts will worsen the long-term budget outlook... will reduce the capacity of the government to finance Social Security and Medicare benefits as well as investments in schools, health, infrastructure, and basic research... [and] generate further inequalities in after-tax income.

"[17] The Bush administration had claimed, based on the concept of the Laffer Curve, that the tax cuts actually paid for the themselves by generating enough extra revenue from additional economic growth to offset the lower taxation rates.

[6] The Congressional Budget Office (CBO) has estimated that extending the 2001 and 2003 tax cuts (which were scheduled to expire in 2010) would cost the U.S. Treasury nearly $1.8 trillion in the following decade, dramatically increasing federal deficits.

President Bush did not take deliberate steps to address pre-tax inequality, which involves policies such as raising the minimum wage, strengthening collective bargaining power (unions), limiting executive pay, and protectionism.

The Comptroller of the Department of Defense (DOD) estimated spending for "Overseas Contingency Operations" (OCO), analogous to the CRS amount above, at $748 billion for the 2001-2008 period.

For example, Nobel laureate Joseph Stiglitz has estimated the total cost of the Iraq War at closer to $3 trillion, considering the long-term care for military personnel, equipment replacement, and other factors.

CBO projected in its January 2001 baseline that the U.S. would have a total of $5.6 trillion in annual surpluses over the 2002-2011 decade, assuming the laws in place during the Clinton era continued and the economy performed as expected.

Increased spending for defense, international affairs, and homeland security – primarily for prosecuting the wars in Iraq and Afghanistan – also was quite costly, amounting to almost $800 billion to date.

"[40] In terms of the budget legacy passed to his successor President Obama, CBO forecast in January 2009 that the deficit that year would be $1.2 trillion, assuming the continuation of Bush policies.

[3] From a policy perspective, the long-term deficit legacy depended significantly on whether the Bush tax cuts were allowed to expire in 2010 as initially legislated.

While generally favoring free trade, Bush has also occasionally supported protectionist measures, notably the 2002 United States steel tariff early in his term.

A significant portion of this borrowing was directed by large financial institutions into mortgage-backed securities and their derivatives, a factor that contributed to the housing bubble and the crises that followed.

Critics have argued this contributed to the subprime mortgage crisis, by encouraging home ownership for those unable to afford them and insufficient regulation of financial institutions.

[50] President Bush signed the Sarbanes-Oxley Act into law during July 2002, which he called "the most far-reaching reforms of American business practices since the time of Franklin Delano Roosevelt."

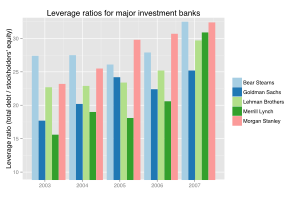

"[57] The Securities and Exchange Commission (SEC) and Alan Greenspan conceded failure in allowing the self-regulation of investment banks, which proceeded to take on increasingly risky bets and leverage after a key 2004 decision.

As uncertainty has grown, many banks have restricted lending, credit markets have frozen, and families and businesses have found it harder to borrow money.

In response to declining housing prices and fears of an impending recession, the Bush administration arranged passage of the Economic Stimulus Act of 2008.

Falling home prices started threatening the financial viability of many institutions, leaving Bear Stearns, a prominent U.S.-based investment bank, on the brink of failure in March 2008.

Recognizing the growing threat of a financial crisis, Bush allowed Treasury secretary Paulson to arrange for another bank, JPMorgan Chase, to take over most Bear Stearn's assets.

Though TARP helped end the financial crisis, it did not prevent the onset of the Great Recession, which would continue long after Bush left office.

[64][65] Fed chair Ben Bernanke explained in 2010 that vulnerabilities in the global financial system built up over a long period of time, and then specific triggering events set the 2007-2008 subprime mortgage crisis into motion.

These investment banks were forced to sell long-term securities at fire-sale prices to meet their daily financing needs, suffering enormous losses.

Treasury Secretary Hank Paulson, who in July had publicly expressed concern that continuous bailouts would lead to moral hazard, decided to let Lehman fail.

Paulson proposed providing liquidity to financial markets by having the government buy up debt related to bad mortgages with a $700 billion Troubled Asset Relief Program.