Economy of Sri Lanka

[36] Sri Lanka has met the Millennium Development Goal (MDG) target of halving extreme poverty and is on track to meet most of the other MDGs, outperforming other South Asian countries.

[49] With the onset of the COVID-19 pandemic, lingering concerns over Sri Lanka's slowing growth, money printing and government debt has spilled over into a series of sovereign rating downgrades.

[60] Faxian (also Fa Hsien) a Chinese Monk who travelled to India and Sri Lanka around 400 AD, writes of existing legends at his time of merchants from other countries trading with native tribal peoples in the island before Indo-Aryan settlement.

[61] To go back to China he "took passage in a large merchantman on board which were more than 200 men", ran into a storm where the merchants were forced to throw part of the cargo overboard and arrived at Java-dvipa (Indonesia), showing Sri Lanka had active coastal and long-distance maritime trade links.

"The island being, as it is, in a central position, is much frequented by ships from all parts of India and from Persia and Ethiopia, and it likewise sends out many of its own," he wrote in Christian Topography.

"And from the remotest countries, I mean Tzinista [China] and other trading places, it receives silk, aloes, cloves, sandalwood and other products, and these again are passed on to marts on this side, such as Male [Malabar or South West Indian coast] ... and to Calliana [Kalyana]...

[64] With its strategic location in the Indian Ocean Sri Lanka was expected to have a better chance than most other Asian neighbours to register a rapid economic take-off and had "appeared to be one of the most promising new nations."

[69] however twenty-five years of civil war slowed economic growth,[citation needed] diversification and liberalisation, and the political group Janatha Vimukthi Peramuna (JVP) uprisings, especially the second in the early 1980s, also caused extensive upheavals.

For the next round of reforms, the central bank of Sri Lanka recommends that Colombo expand market mechanisms in nonplantation agriculture, dismantle the government's monopoly on wheat imports, and promote more competition in the financial sector.

[73] During this time, the EU revoked GSP plus preferential tariffs from Sri Lanka due to alleged human rights violations, which cost about US$500 million a year.

[95] In June 2022, Prime Minister Ranil Wickremesinghe declared in parliament the collapse of the Sri Lankan economy, leaving it unable to pay for essentials.

[98] Exports $10.3 billion (2020)[106] Imports $14.9 billion (2020)[107] After two years of money printing and tax cuts made for fiscal and monetary stimulus, Sri Lanka declared a 'pre-emptive negotiated default' saying most foreign debt would not be repaid from April 12 [108] Fitch Ratings downgraded Sri Lanka to 'C' from 'CC' and said the country would be further downgraded to restricted default (RD) once the first payment was missed.

[111][112] In 2021 Sri Lanka grew 4% amid though excessive central bank financing had led to balance of payments deficits and foreign exchange shortages.

[113][114] Despite progress in managing Coronavirus, external debt remains a challenge amid concerns over money printing under Modern Monetary Theory independent economists had warned earlier.

Standard and Poor's maintained Sri Lanka was constrained by providing widespread subsidies, a bloated public sector, transfers to loss-making state enterprises, and high interest local and international burdens [1].

"The Central Bank is of the view that continued support through monetary and fiscal interventions is essential to provide adequate impetus to the economy amidst the challenging domestic and global macroeconomic conditions," Governor W D Lakshman said in January 2021.

Given the changes taking place in the private credit space (i.e. the retail tilt), and provided the CBSL's recent policy rate cut in April 2018, credit growth may still continue to move either horizontally (i.e. at a 15% level) or continue to reduce slightly given anticipated near term inflationary pressures, as the consumption-led borrowings may also tend to decline on account of the anticipated reduction in near term disposable income.

The headquarters of the CSE has been located at the World Trade Center Towers [6] in Colombo since 1995 and it also has branches across the country in Kandy, Matara, Kurunegala, Negombo and Jaffna.

Sri Lanka's commercial and economic centres, primarily the capitals of the nine provinces are connected by the "A-Grade" roads which are categorically organised and marked.

[148] Information technology literacy of the urban sector population is also satisfactory at 39.9 per cent and people around the country use web-based job boards to find skilled employment together with other sources such as newspapers and government gazette.

The 2019 Easter Sunday bombings reduced arrivals to 1,913,702 though authorities acted quickly to round up the group and travel advisories were relaxed by key generating markets such as the UK as early as June 2019.

In June 2021, Sri Lanka started the first 100% organic farming or biological agriculture program and imposed a countrywide ban on inorganic fertilizers and pesticides.

[176] In September 2021 the government announced "economic emergency", as the situation was further aggravated by falling national currency exchange rate, inflation rising as result of high food prices, and pandemic restrictions in tourism which further decreased country's income.

Contrary to popular belief Ceylon produces sapphires of all colours,[187] including padparascha types, though blue is the most desirable and yields the highest prices.

"Without an IMF loan, Sri Lanka would have been in a precarious position" in May 2016, according to Krystal Tan, an Asia economist at Capital Economics, who added, "foreign exchange reserves only covered around 80 per cent of short-term external debt.

The central bank indicates its readiness to tighten the monetary policy stance further if inflationary pressures resurge or credit growth persists.

Going forward, there is a need to strengthen the supervisory and regulatory framework, and identify and mitigate vulnerabilities in the financial sector, particularly with regard to non-banks and state-owned banks.

"[197] As part of the debt management program, the Sri Lankan government carried out several reforms which included the implementation of a new Inland Revenue Act as well as an automatic fuel pricing formula.

Tax reforms also increased VAT rates and narrowed exemptions and the third review by the IMF noted that performance was on track regarding fiscal consolidation, revenue mobilization, monetary policy management, and reserves accumulation.

[201][202] A strong and credible structural reform program is critical to avoid a prolonged crisis and address the (above) root causes of the current economic difficulties.

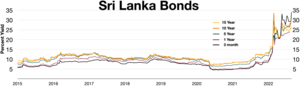

Inverted yield curve in the first half of 2022

In early March 2022, the Sri Lankan Rupee began losing value quickly.