Endogenous risk

[1][2] Risk can be classified into the two categories of exogenous and endogenous.

Exogenous risk is risk stemming from factors outside the financial system, such as political instability, natural disasters, or a pandemic, which may have severe effects on asset prices.

By contrast, endogenous risk is risk stemming from the behaviour of participants within the financial system, such as when positive economic outlooks cause innovation of new financial products, increased leverage, and speculation; these self-reinforcing processes feed on each other to increase risk.

Such endogenous factors, Danielsson and Shin claim, are behind most tail events and severe financial crises.

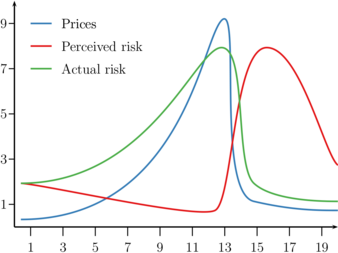

Shown in the figure on the right, as a financial asset enters into a bubble state, followed by a crash, perceived risk reported by typical risk measures, falls as the bubble builds up, sharply increasing after the bubble deflates.