Equalization Payments in Germany

[1] Equalization payments are the most commonly known system for the redistribution of revenue in Germany and are an important tool for the financing of regional development.

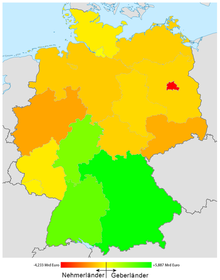

[5] The aim, as laid out in the German constitution, is to balance the differing financial strengths of the federal states.

Through this process the funding requirements of the federation and states are coordinated with the aim of agreeing equalization payments, this ensures that tax payers are not overburdened and maintains consistency in the standard of living across Germany.

In order to ensure that this process guaranteed a unified budgetary policy, and to avoid the free rider problem, the federation and states budgets have been reviewed by a Stabilitätsrat or Stability Council since 2009.

They basically received a proportional allocation of tax receipts divided among the states based on regional income and population.

In the consultations of the Parliamentary Council over the future constitution of the Federal Republic of Germany such financial dependency was to be avoided.

The clause relating to up front value added tax adjustments, which was introduced into the constitution in 1969, gained in importance after reunification with the introduction of equalization payments for all the states in 1995.

As part of the provisions of the first solidarity pact the federation allocated an extra seven percent of value added tax which flowed especially to the weaker former east German states.

Owing to various legal actions individual parts of the financial constitution have been adjusted many times, but the reforms have held true for more than 40 years and have allowed the fiscal integration of the new states after reunification.