FDIC Enterprise Architecture Framework

[3] The Federal Deposit Insurance Corporation (FDIC) first realized the value of Enterprise Architecture in 1997, when two business executives had to reconcile data that had come from different systems for a high-profile report to the banking industry.

[4] In 2004 the FDIC received a 2004 Enterprise Architecture Excellence Award from the Zachman Institute for Framework Advancement (ZIFA) for its initiative to manage corporate data collaboratively.

The banking business model of 2008 had become more complex, giving rise to financial instruments such as collateralized debt obligations (CDOs) and structured investment vehicles (SIVs) to manage risk.

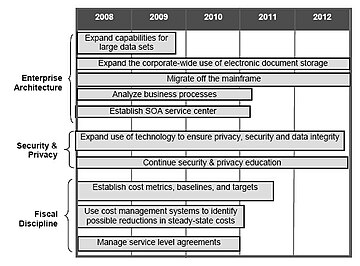

Efficiencies were also hoped to be gained by expanding capabilities for manipulating large data sets and storing traditional paper-based files electronically.

In some cases, technology, such as scanning outgoing e-mail for sensitive information and encrypting removable storage devices, could mitigate potential risks.

[6] Lastly, in order to continue sound fiscal discipline and responsibility, the organization planned to establish IT baselines and metrics, study steady-state costs, manage service level agreements, and more judiciously choose new development projects.