Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.

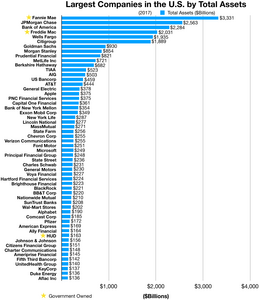

45 on the 2023 Fortune 500 list of the largest United States corporations by total revenue, and has $3.208 trillion in assets under management.

[16] In 1989, the Financial Institutions Reform, Recovery and Enforcement Act of 1989 ("FIRREA") revised and standardized the regulation of Fannie Mae and Freddie Mac.

An 18-member board of directors for Freddie Mac was formed, and subjected to oversight by the U.S. Department of Housing and Urban Development (HUD).

In 1995, Freddie Mac began receiving affordable housing credit for buying subprime securities, and by 2004, HUD suggested the company was lagging behind and should "do more".

[18] Freddie Mac's primary method of making money is by charging a guarantee fee on loans that it has purchased and securitized into mortgage-backed security (MBS) bonds.

That is, Freddie Mac guarantees that the principal and interest on the underlying loan will be paid back regardless of whether the borrower actually repays.

There is a widespread belief that FHLMC securities are backed by some sort of implied federal guarantee and a majority of investors believe that the government would prevent a disastrous default.

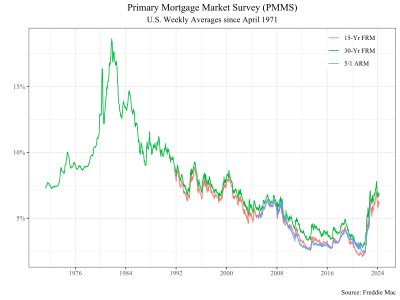

From 2001 to 2003, financial institutions experienced high earnings due to an unprecedented re-financing boom brought about by historically low interest rates.

When interest rates eventually rose, financial institutions sought to maintain their elevated earnings levels with a shift toward riskier mortgages and private label MBS distribution.

[26] The growth of PLS, however, forced the GSEs to lower their underwriting standards in an attempt to reclaim lost market share to please their private shareholders.

In July 2008, the government attempted to ease market fears by reiterating their view that "Fannie Mae and Freddie Mac play a central role in the US housing finance system".

The U.S. Treasury Department and the Federal Reserve took steps to bolster confidence in the corporations, including granting both corporations access to Federal Reserve low-interest loans (at similar rates as commercial banks) and removing the prohibition on the Treasury Department to purchase the GSEs' stock.

[55] On April 18, 2006, Freddie Mac was fined $3.8 million, by far the largest amount ever assessed by the Federal Election Commission, as a result of illegal campaign contributions.

Much of the illegal fund raising benefited members of the House Financial Services Committee, a panel whose decisions can affect Freddie Mac.

Notably, Freddie Mac held more than 40 fundraisers for House Financial Services Chairman Michael Oxley (R-OH).

[56] Both Fannie Mae and Freddie Mac often benefited from an implied guarantee of fitness equivalent to truly federally backed financial groups.

The US Treasury Department and the Federal Reserve took several steps to bolster confidence in the corporations, including extending credit limits, granting both corporations access to Federal Reserve low-interest loans (at similar rates as commercial banks), and potentially allowing the Treasury Department to own stock.

On May 23, 2006, the Fannie Mae and Freddie Mac regulator, the Office of Federal Housing Enterprise Oversight, issued the results of a 27-month-long investigation.

[61] On May 25, 2006, Senator McCain joined as a co-sponsor to the Federal Housing Enterprise Regulatory Reform Act of 2005 (first put forward by Sen. Chuck Hagel)[62] where he pointed out that Fannie Mae and Freddie Mac's regulator reported that profits were "illusions deliberately and systematically created by the company's senior management".

[68][69] The top 10 recipients of campaign contributions from Freddie Mac and Fannie Mae during the 1989 to 2008 time period include five Republicans and five Democrats.

[5][6] The announcement followed reports two days earlier that the Federal government was planning to take over Fannie Mae and Freddie Mac and had met with their CEOs on short notice.

[73][74][75] The authority of the U.S. Treasury to advance funds for the purpose of stabilizing Fannie Mae or Freddie Mac is limited only by the amount of debt that the entire federal government is permitted by law to commit to.

The July 30, 2008, law enabling expanded regulatory authority over Fannie Mae and Freddie Mac increased the national debt ceiling by US$800 billion, to a total of US$10.7 trillion in anticipation of the potential need for the Treasury to have the flexibility to support the federal home loan banks.

The bill, if it were passed, would modify the budgetary treatment of federal credit programs, such as Fannie Mae and Freddie Mac.