United States federal budget

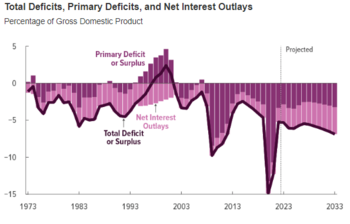

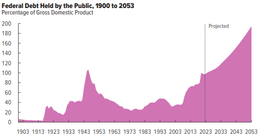

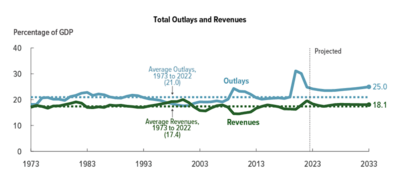

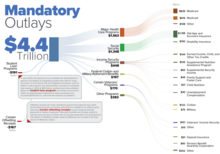

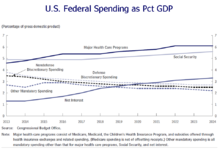

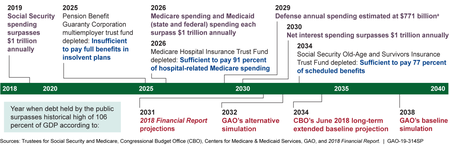

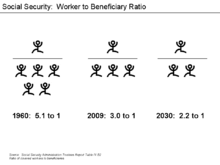

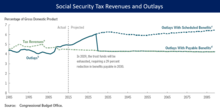

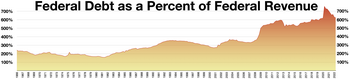

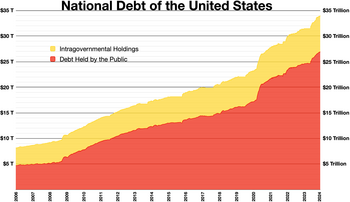

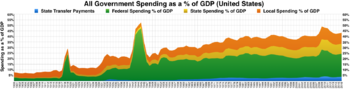

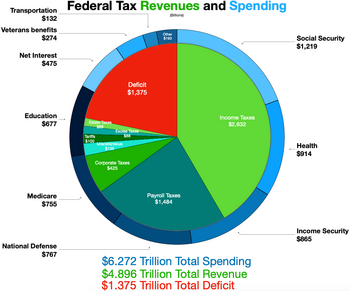

These agencies have reported that the federal government is facing many important long-run financing challenges, primarily driven by an aging population, rising interest payments, and spending for healthcare programs like Medicare and Medicaid.

By contrast, many businesses and some other national governments have adopted forms of accrual accounting, which recognizes obligations and revenues when they are incurred.

Appropriations bills must pass both the House and Senate and then be signed by the president in order to give federal agencies the legal budget authority to spend.

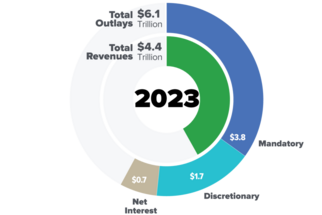

Outlays refer to the issuance of checks, disbursement of cash or electronic transfer of funds made to liquidate a federal obligation and is usually synonymous with "expenditure" or "spending".

Authorization bills are also useful when giving a federal agency the right to borrow money, sign contracts, or provide loan guarantees.

The GAO and the Treasury issue Financial Statements of the U.S. Government, usually in the December following the close of the federal fiscal year, which occurs September 30.

The Treasury Department also produces a Combined Statement of Receipts, Outlays, and Balances each December for the preceding fiscal year, which provides detailed data on federal financial activities.

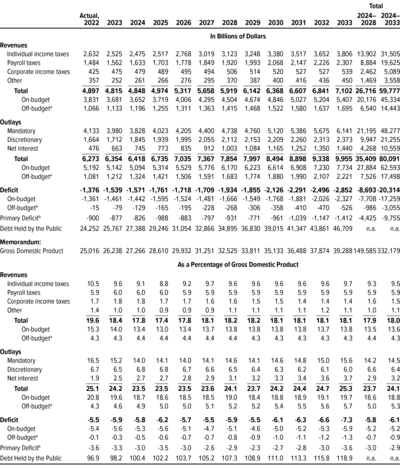

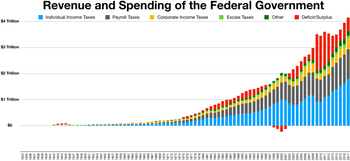

Historical tables within the President's Budget (OMB) provide a wide range of data on federal government finances.

The purpose of these tables is to present a broad range of historical budgetary data in one convenient reference source and to provide relevant comparisons likely to be most useful.

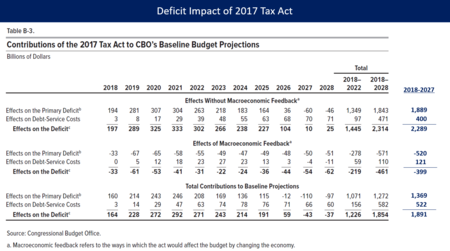

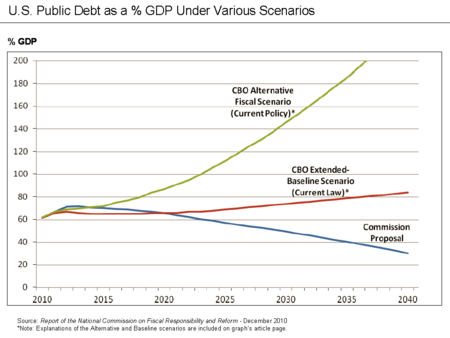

CBO also identified scenarios involving significant austerity measures, which maintain or reduce the debt relative to GDP over time.

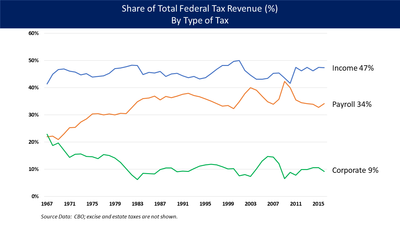

[18] In other words, eliminating the tax expenditures for the top 20% might balance the budget over the short-term, depending on economic feedback effects.

This unfavorable combination of demographics and per-capita rate increases is expected to drive both Social Security and Medicare into large deficits during the 21st century.

Prior to 2009, spending for the wars in Iraq and Afghanistan was often funded through special appropriations excluded from the budget deficit calculation.

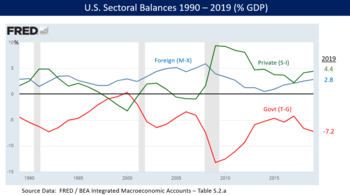

The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust.

Conversely, Republicans and Libertarians generally support applying the principles of either laissez-faire or supply-side economics to grow the economy via small government, low taxes, limited regulation, and free enterprise.

For example, Congress adding to the debt today may or may not enhance the quality of life for future generations, who must also bear the additional interest and taxation burden.

While Republicans argue conceptually for reductions in Medicare and Social Security, they are hesitant to actually vote to reduce the benefits from these popular programs.

The forecasts from 2009 and 2015 differ materially, mainly due to changes in the projected rate of healthcare cost increases, which have moderated considerably.

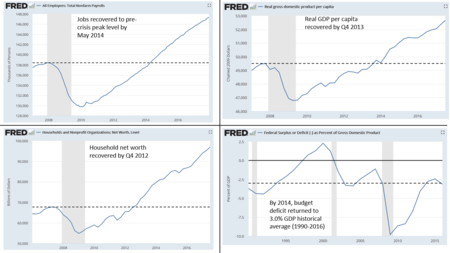

[85] In the wake of the 2007–2009 U.S. recession, there were several important fiscal debates around key questions: The COVID-19 pandemic in the United States impacted the economy significantly beginning in March 2020, as businesses were shut-down and furloughed or fired personnel.

As a result of the adverse economic impact, both state and federal budget deficits will dramatically increase, even before considering any new legislation.

[88] To help address lost income for millions of workers and assist businesses, Congress and President Trump enacted the Coronavirus Aid, Relief, and Economic Security Act (CARES) on March 18, 2020.

Some or all of the loans may ultimately be paid back including interest, while the spending measures should dampen the negative budgetary impact of the economic disruption.

[89] CBO provided a preliminary score for the CARES Act on April 16, 2020, estimating that it would increase federal deficits by about $1.8 trillion over the 2020-2030 period.

In particular, the act authorizes the Secretary of the Treasury to provide up to $454 billion to fund emergency lending facilities established by the Board of Governors of the Federal Reserve System.

[92] While the Federal Reserve is also conducting stimulative monetary policy, essentially "printing money" electronically to purchase bonds, its balance sheet is not a component of the national debt.

[95] According to a December 2012 Pew Research Center poll, only a few of the frequently discussed deficit reduction ideas have majority support: Fewer than 50% support raising the retirement age for Social Security or Medicare, reducing military defense spending, limiting the mortgage interest deduction, or reducing federal funding for low income persons, education and infrastructure.

Unless laws governing fiscal policy were changed—that is, spending for large benefit programs was reduced, increases in revenues were implemented, or some combination of those approaches was adopted—debt would rise sharply relative to GDP after 2027.During June 2012, Federal Reserve Chair Ben Bernanke recommended three objectives for fiscal policy: 1) Take steps to put the federal budget on a sustainable fiscal path; 2) Avoid unnecessarily impeding the ongoing economic recovery; and 3) Design tax policies and spending programs to promote a stronger economy.

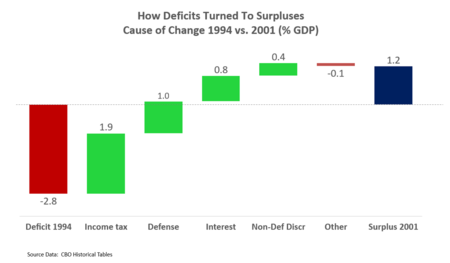

One helpful way of measuring the impact of the plans is to compare them in terms of revenue and expense as a percentage of GDP over time, in total and by category.

Prior to the 2008-2009 U.S. recession, experts argued for steps to be put in place immediately to address an unsustainable trajectory of federal deficits.

"[122] IMF managing director Christine Lagarde wrote in August 2011[123] For the advanced economies, there is an unmistakable need to restore fiscal sustainability through credible consolidation [deficit reduction] plans.