Taxation in the United States

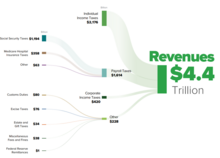

Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees.

[5] The United States is one of two countries in the world that taxes its non-resident citizens on worldwide income, in the same manner and rates as residents.

Estate and gift taxes are imposed by the federal and some state governments on the transfer of property inheritance, by will, or by lifetime donation.

Source and Method[28][29] The U.S. system allows reduction of taxable income for both business[31] and some nonbusiness[32] expenditures, called deductions.

[48] Amounts to be withheld are computed by employers based on representations of tax status by employees on Form W-4, with limited government review.

Most states conform to many federal concepts and definitions, including defining income and business deductions and timing thereof.

The tax base is adjusted gross income reduced by a fixed deduction that varies by taxpayer filing status.

Itemized deductions of individuals are limited to home mortgage interest, charitable contributions, and a portion of medical expenses.

In the United States, taxable income is computed under rules that differ materially from U.S. generally accepted accounting principles.

The penalty of up to 100% of the amount not paid can be assessed against the employer entity as well as any person (such as a corporate officer) having control or custody of the funds from which payment should have been made.

Failure to properly comply with customs rules can result in seizure of goods and criminal penalties against involved parties.

"Imported goods are not legally entered until after the shipment has arrived within the port of entry, delivery of the merchandise has been authorized by CBP, and estimated duties have been paid.

Goods must be declared for entry into the U.S. within 15 days of arrival or prior to leaving a bonded warehouse or foreign trade zone.

Extensive modifications to normal duties and classifications apply to goods originating in Canada or Mexico under the [North American Free Trade Agreement].

All goods that are not exempt are subject to duty computed according to the Harmonized Tariff Schedule published by CBP and the U.S. International Trade Commission.

Special use valuation applies to farms and closely held businesses, subject to limited dollar amount and other conditions.

Many jurisdictions within the United States impose taxes or fees on the privilege of carrying on a particular business or maintaining a particular professional certification.

Common examples include accountants, attorneys, barbers, casinos, dentists, doctors, auto mechanics, plumbers, and stockbrokers.

These laws specifically authorize the United States Secretary of the Treasury to delegate various powers related to levy, assessment and collection of taxes.

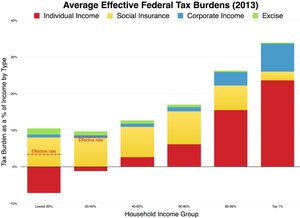

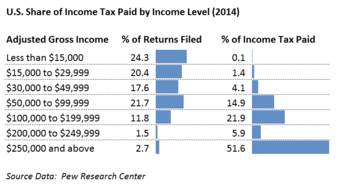

[116][117][118] Commentators Benjamin Page, Larry Bartels, and Jason Seawright contend that Federal tax policy in relation to regulation and reform in the United States tends to favor wealthy Americans.

They assert that political influence is a legal right the wealthy can exercise by contributing funds to lobby for their policy preference.

On the other hand, it is important to consider that interest can significantly increase the total amount owed, so the user should take care of his tax obligations as soon as possible and in an efficient manner so that he can avoid any additional charges.

This fact was mostly revealed in the leaked Pandora papers – 11.9 million documents that, beginning from October 31, 2021, exposed offshore accounts of world leaders and celebrities.

Trusts in South Dakota also serve as shields from government inspections and can even protect an individual if they get divorced or file a bankruptcy.

[144] Corporation trust center in the city of Wilmington is the address to over 285,000 companies including Delaware entities of Google, Amazon, General Motors, Deutsche Bank's subsidiaries etc.

Property such as a trademark is hard to put an exact number on which offers the companies a lot of leeway on how much money they move to Delaware.

Nevada also does not have an agreement with the IRS on sharing information, so some entities choose to incorporate here as to enjoy the benefits of high privacy.

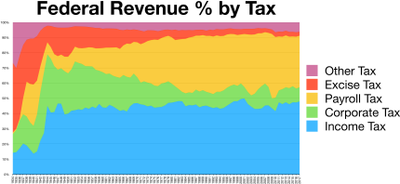

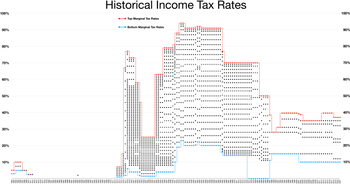

[154] In 1913, the Sixteenth Amendment to the United States Constitution was ratified, permitting the federal government to levy an income tax on both property and labor.

As was found in Britain this proved to be one of the worst systems as it imposed a huge burden on revenue authorities to correlate large quantities of information.

[156] In 1986, Congress adopted, with little modification, a major expansion of the income tax portion of the IRS Code proposed in 1985 by the U.S. Treasury Department under President Reagan.

3%

6%

9%

12%

-$500, $1,000, $2,000, $3,000, $4,000, $5,000, $6,000, $7,000+