Financial economics

The subject is thus built on the foundations of microeconomics and derives several key results for the application of decision making under uncertainty to the financial markets.

, and that the complete set of possible bets on future states-of-the-world can therefore be constructed with existing assets (assuming no friction): essentially solving simultaneously for n (risk-neutral) probabilities,

In pricing a "fundamental", underlying, instrument (in equilibrium), on the other hand, a risk-appropriate premium over risk-free is required in the discounting, essentially employing the first equation with

The difference is explained as follows: By construction, the value of the derivative will (must) grow at the risk free rate, and, by arbitrage arguments, its value must then be discounted correspondingly; in the case of an option, this is achieved by "manufacturing" the instrument as a combination of the underlying and a risk free "bond"; see Rational pricing § Delta hedging (and § Uncertainty below).

State prices find immediate application as a conceptual tool ("contingent claim analysis");[6] but can also be applied to valuation problems.

Later developments show that, "rationally", i.e. in the formal sense, the appropriate discount rate here will (should) depend on the asset's riskiness relative to the overall market, as opposed to its owners' preferences; see below.

Williams and onward allow for forecasting as to these – based on historic ratios or published dividend policy – and cashflows are then treated as essentially deterministic; see below under § Corporate finance theory.

For both stocks and bonds, "under certainty, with the focus on cash flows from securities over time," valuation based on a term structure of interest rates is in fact consistent with arbitrage-free pricing.

Whereas these "certainty" results are all commonly employed under corporate finance, uncertainty is the focus of "asset pricing models" as follows.

For "choice under uncertainty" the twin assumptions of rationality and market efficiency, as more closely defined, lead to modern portfolio theory (MPT) with its capital asset pricing model (CAPM) – an equilibrium-based result – and to the Black–Scholes–Merton theory (BSM; often, simply Black–Scholes) for option pricing – an arbitrage-free result.

[note 8] Under these conditions, investors can then be assumed to act rationally: their investment decision must be calculated or a loss is sure to follow; [32] correspondingly, where an arbitrage opportunity presents itself, then arbitrageurs will exploit it, reinforcing this equilibrium.

Then, given this CML, the required return on a risky security will be independent of the investor's utility function, and solely determined by its covariance ("beta") with aggregate, i.e. market, risk.

This is because investors here can then maximize utility through leverage as opposed to pricing; see Separation property (finance), Markowitz model § Choosing the best portfolio and CML diagram aside.

[note 12] The linear factor model structure of the APT is used as the basis for many of the commercial risk systems employed by asset managers.

Where factors additional to volatility are considered (kurtosis, skew...) then multiple-criteria decision analysis can be applied; here deriving a Pareto efficient portfolio.

[6][45][22] For path dependent derivatives, Monte Carlo methods for option pricing are employed; here the modelling is in continuous time, but similarly uses risk neutral expected value.

The more general HJM Framework describes the dynamics of the full forward-rate curve – as opposed to working with short rates – and is then more widely applied.

[69] [70] [71] [64] And using the CAPM – or extensions – the discounting here is at the risk-free rate plus a premium linked to the uncertainty of the entity or project cash flows [64] (essentially,

"Corporate finance" as a discipline more generally, building on Fisher above, relates to the long term objective of maximizing the value of the firm - and its return to shareholders - and thus also incorporates the areas of capital structure and dividend policy.

Research here considers how, and to what extent, regulations relating to disclosure (earnings guidance, annual reports), insider trading, and short-selling will impact price efficiency, the cost of equity, and market liquidity.

[note 17] This approach, essentially simulated trade between numerous agents, "typically uses artificial intelligence technologies [often genetic algorithms and neural nets] to represent the adaptive behaviour of market participants".

[84] Agent-based models depart further from the classical approach — the representative agent, as outlined — in that they introduce heterogeneity into the environment (thereby addressing, also, the aggregation problem).

As above, there is a very close link between: the random walk hypothesis, with the associated belief that price changes should follow a normal distribution, on the one hand; and market efficiency and rational expectations, on the other.

Models here are first calibrated to observed prices, and are then applied to the valuation or hedging in question; the most common are Heston, SABR and CEV.

[89] Related to local volatility are the lattice-based implied-binomial and -trinomial trees – essentially a discretization of the approach – which are similarly, but less commonly,[20] used for pricing; these are built on state-prices recovered from the surface.

This is valid as the surface is built on price data relating to fully collateralized positions, and there is therefore no "double counting" of credit risk (etc.)

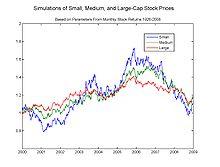

[93] Various persistent market anomalies have also been documented as consistent with and complementary to price or return distortions – e.g. size premiums – which appear to contradict the efficient-market hypothesis.

His Black swan theory emphasizes that although events of large magnitude and consequence play a major role in finance, since these are (statistically) unexpected, they are "ignored" by economists and traders.

The latter is extended to agent-based computational models; here, [82] as mentioned, price is treated as an emergent phenomenon, resulting from the interaction of the various market participants (agents).

However, studies show that despite inefficiencies, asset prices generally follow a random walk, making it difficult to consistently outperform market averages and achieve "alpha".