Greeks (finance)

The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures).

For this reason, those Greeks which are particularly useful for hedging—such as delta, theta, and vega—are well-defined for measuring changes in the parameters spot price, time and volatility.

The players in the market make competitive trades involving many billions (of $, £ or €) of underlying every day, so it is important to get the sums right.

The use of Greek letter names is presumably by extension from the common finance terms alpha and beta, and the use of sigma (the standard deviation of logarithmic returns) and tau (time to expiry) in the Black–Scholes option pricing model.

The names "color" and "charm" presumably derive from the use of these terms for exotic properties of quarks in particle physics.

By put–call parity, long a call and short a put is equivalent to a forward F, which is linear in the spot S, with unit factor, so the derivative dF/dS is 1.

(Albeit for only small movements of the underlying, a short amount of time and not-withstanding changes in other market conditions such as volatility and the rate of return for a risk-free investment).

[5] For this reason some option traders use the absolute value of delta as an approximation for percent moneyness.

Similarly, if a put contract has a delta of −0.25, the trader might expect the option to have a 25% probability of expiring in-the-money.

Vega is typically expressed as the amount of money per underlying share that the option's value will gain or lose as volatility rises or falls by 1 percentage point.

Rho is typically expressed as the amount of money, per share of the underlying, that the value of the option will gain or lose as the risk-free interest rate rises or falls by 1.0% per annum (100 basis points).

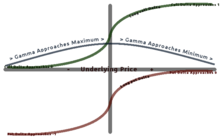

[11] Gamma is greatest approximately at-the-money (ATM) and diminishes the further out you go either in-the-money (ITM) or out-of-the-money (OTM).

Vanna,[4] also referred to as DvegaDspot[13] and DdeltaDvol,[13] is a second-order derivative of the option value, once to the underlying spot price and once to volatility.

This use is fairly accurate when the number of days remaining until option expiration is large.

When an option nears expiration, charm itself may change quickly, rendering full day estimates of delta decay inaccurate.

Vomma,[4] volga,[15] vega convexity,[15] or DvegaDvol[15] measures second-order sensitivity to volatility.

And an initially vega-neutral, long-vomma position can be constructed from ratios of options at different strikes.

The word 'Vera' was coined by R. Naryshkin in early 2012 when this sensitivity needed to be used in practice to assess the impact of volatility changes on rho-hedging, but no name yet existed in the available literature.

'Vera' was picked to sound similar to a combination of Vega and Rho, its respective first-order Greeks.

This name is now in a wider use, including, for example, the Maple computer algebra software (which has 'BlackScholesVera' function in its Finance package).

Color is a third-order derivative of the option value, twice to underlying asset price and once to time.

Color can be an important sensitivity to monitor when maintaining a gamma-hedged portfolio as it can help the trader to anticipate the effectiveness of the hedge as time passes.

This use is fairly accurate when the number of days remaining until option expiration is large.

[20] Parmicharma is a third-order derivative of the option value, twice to time and once to underlying asset price.

In order to better maintain a delta-hedge portfolio as time passes, the trader may hedge charm in addition to their current delta position.

[24] The Greeks of European options (calls and puts) under the Black–Scholes model are calculated as follows, where

For a given: where Under the Black model (commonly used for commodities and options on futures) the Greeks can be calculated as follows: where (*) It can be shown that

The closest analogue to the delta is DV01, which is the reduction in price (in currency units) for an increase of one basis point (i.e. 0.01% per annum) in the yield, where yield is the underlying variable; see Bond duration § Risk – duration as interest rate sensitivity.

In general, the higher the convexity, the more sensitive the bond price is to the change in interest rates.

These values are typically calculated using a tree-based model, built for the entire yield curve (as opposed to a single yield to maturity), and therefore capturing exercise behavior at each point in the option's life as a function of both time and interest rates; see Lattice model (finance) § Interest rate derivatives.