Financial contagion

[4] More generally, there is controversy surrounding the usefulness of "contagion" as a metaphor to describe the "catchiness" of social phenomena, as well as debate about the application of context-specific models and concepts from biomedicine and epidemiology to explain the diffusion of perturbations within financial systems.

"Any major trading partner of a country in which a financial crisis has induced a sharp current depreciation could experience declining asset prices and large capital outflows or could become the target of a speculative attack as investors anticipate a decline in exports to the crisis country and hence a deterioration in the trade account.

"[1] Kaminsky and Reinhart (2000)[9] document the evidence that trade links in goods and services and exposure to a common creditor can explain earlier crises clusters, not only the debt crisis of the early 1980s and 1990s, but also the observed historical pattern of contagion.

A financial crisis as a branch of contagion is formed when "a co-movement occurs, even when there are no global shocks and interdependence and fundamentals are not factors.

Some examples that can cause contagion are increased risk aversion, lack of confidence, and financial fears.

"These losses may induce investors to sell off securities in other markets to raise cash in anticipation of a higher frequency of redemptions.

For instance, the first signs of a crisis may cause investors to sell their holdings in some countries, resulting in equity and different asset markets in economies to decline in value.

Some explanations for financial contagion, especially after the Russian default in 1998, are based on changes in investor "psychology", "attitude", and "behavior".

[13] Also, Kirman (1993) analyses a simple model of influence that is motivated by the foraging behavior of ants, but applicable, he argues, to the behaviour of stock market investors.

[15] Eichengreen, Hale and Mody (2001) focus on the transmission of recent crises through the market for developing country debt.

They also find market sentiments can more influence prices but less on quantities in Latin America, compared with Asian countries.

The term "contagion" was first introduced in July 1997, when the currency crisis in Thailand quickly spread throughout East Asia and then on to Russia and Brazil.

Even developed markets in North America and Europe were affected, as the relative prices of financial instruments shifted and caused the collapse of Long-Term Capital Management (LTCM), a large U.S. hedge fund.

The financial crisis beginning from Thailand with the collapse of the Thai baht spread to Indonesia, the Philippines, Malaysia, South Korea and Hong Kong in less than two months.

[18] This caused economists to realize the importance of financial contagion and produced a large volume of researches on it.

"The liberation of Latin American in the early 1820s led to a massive inflow of capital from Britain to finance the exploitation of gold and silver mines and of sovereign loans to the newly independent republics.

"This crisis spread to Latin America as the overseas loans were cut off, a decline in investment and exports reduced tax revenues and led to sovereign debt defaults across the region.

The stock market boom in New York by 1928 choked off U.S. capital flows to central Europe and Latin America and precipitated currency crises in a number of countries (Australia, Argentina, Uruguay, and Brazil) and early in 1929.

The U.S. crisis in 1929 turned into the Great Depression by 1930 and 1931 because the Federal Reserve was unsuccessful at relieving multiple banking panics.

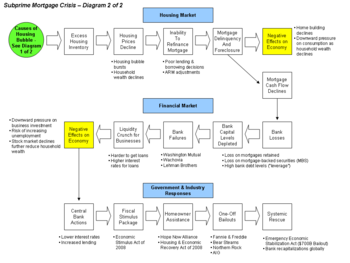

The history of the 2007–08 crisis traces back to the bursting of the housing bubble in the United States, and the increase in mortgage defaults.

Other financial institutions, such as the Lehman bank and American International Group (AIG), started to feel the effects of the crisis.

This move caused major financial problems across the world, especially for those countries that rely heavily on international borrowing.

At domestic level, financial fragility is always associated with a short maturity of outstanding debt as well as contingent public liabilities.

The econometric literature on testing for contagion has focused on increases in the correlation of returns between markets during periods of crisis.

Then, they use the estimated variance-covariance matrices to calculate the cross-market correlation coefficients (and their asymptotic distributions) for each set of markets and periods.

[23] To disentangle contagion from interaction effects, county-specific variables have to be used to instrument foreign returns.

The financial and economic literature presents ample evidence that in time of crisis co-movements between the returns of assets increase.

Recently, Nasini and Erdemlioglu[28] have proposed a model to study how the effects on stock price dynamics of different network propagation channels vary according to the state of the economy.

Drawing on the view that decisions and outcomes of financial firms are influenced by multiple network channels, they studied the stock price dynamics of listed enterprises connected by supply-chain relationships, competition linkages and business partnerships.

, Next to it, their approach allows decomposing the financial dynamics into networks propagation and firms structural positions effects.