Financial position of the United States

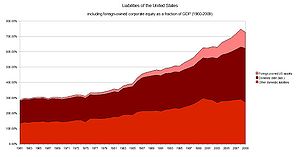

[1] As of 2009, there was $50.7 trillion of debt owed by US households, businesses, and governments, representing more than 3.5 times the annual gross domestic product of the United States.

[3] Tangible assets in 2008 (such as real estate and equipment) for selected sectors[c] totaled an additional $56.3 trillion.

[7] The net worth of the United States and its economic sectors has remained relatively consistent over time.

The total net worth of the United States remained between 4.5 and 6 times GDP from 1960 until the 2000s, when it rose as high as 6.64 times GDP in 2006, principally due to an increase in the net worth of US households in the midst of the United States housing bubble.

The net worth of the United States sharply declined to 5.2 times GDP by the end of 2008 due to declines in the values of US corporate equities and real estate in the wake of the subprime mortgage crisis and the 2007–2008 financial crisis.

SOURCE: Federal Reserve Bank Z-1 Flow of Funds Statement, End of 2011 Accounts[10] SOURCE: U.S. Bureau of Economic Analysis, 2010 Accounts[11] SOURCE: U.S. Bureau of Economic Analysis, 2010 Accounts[12] A GSE issues and GSE/Agency-backed mortgage pool securities (together $7751.8 billion) plus commercial paper ($623.5 billion) B Consumer credit C Commercial paper The Federal Reserve issues routine reports on the flows and levels of debt in the United States.

[2] In April 2011, International Monetary Fund said that, "The US lacks a "credibility strategy" to stabilise its mounting public debt, posing a small but significant risk of a new global economic crisis.

[2] Most debt owed by the US financial sector is in the form of federal government sponsored enterprise (GSE) issues and agency-backed securities.

[16] This coincided with Federal Reserve chairman Paul Volcker's strategy of combating stagflation by raising the federal funds rate; as a result the prime rate peaked at 21.5%, making financing through credit markets prohibitively expensive.

[19] According to the McKinsey Global Institute, the 2007–2008 financial crisis was caused by "unsustainable levels of household debt."

This is more than double the assets held by the federal government in 2007 ($686 billion), mainly due to the acquisition of corporate equities, credit market debt, and cash.

[28] Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk.

[29][30] Lawrence Summers, Matthew Yglesias and other economists state that at such low rates, government debt borrowing saves taxpayer money, and improves creditworthiness.

[29][33] In January, 2012, the U.S. Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association unanimously recommended that government debt be allowed to auction even lower, at negative absolute interest rates.

[36] The notional value of derivative contracts held by US financial institutions is $216.5 trillion, or more than 15 times US GDP.

[36] Netting reduces the credit exposure of the US financial system to derivatives by more than 90%, as compared to 50.6% at the beginning of 1998.

Further, there is a private sector financial surplus due to household savings exceeding business investment.

The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust.

"[45] Economist Paul Krugman also explained in December 2011 the causes of the sizable shift from private deficit to surplus: "This huge move into surplus reflects the end of the housing bubble, a sharp rise in household saving, and a slump in business investment due to lack of customers.

"[46] General: International: United States Derivatives, the great unknown with respect to its impact on the total US cumulative debt